Indonesia Moves To Reduce Chinese Ownership of Nickel Projects

INDONESIA REPORT

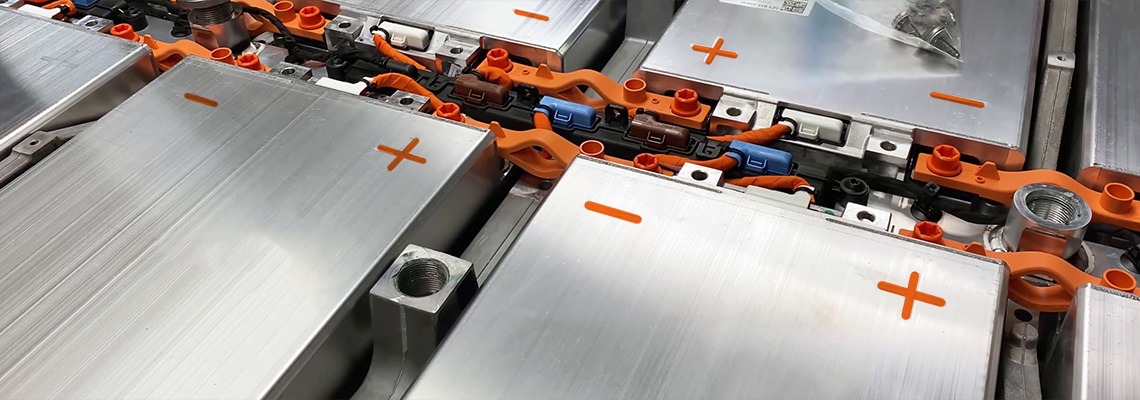

Indonesia is trying to reduce Chinese investment in new nickel mining and smelting operations in order to qualify for U.S. tax incentives. Under the Biden administration’s Inflation-Reduction Act (IRA), large tax incentives will apply after 2025. However, it does not apply to batteries sourced from “foreign entities of concern,” such as companies in which Chinese capital holds more than 25% of the shares, or to EVs that use nickel or other key minerals. Indonesia’s nickel industry will be hit hard by these conditions. This is because the country has been the world’s largest producer of nickel for the past four years, thanks to a large influx of Chinese capital into its mining and smelting operations.

According to three people familiar with the matter, the Indonesian government and the nickel industry are working on new investment projects in which Chinese companies will have a smaller stake. It is possible that the nickel supplied through these deals will be eligible for tax benefits under the IRA. However, in order for the Indonesian nickel industry to receive tax benefits, it will also need to negotiate a trade agreement with the United States. The Indonesian side is proposing an agreement limited to critical minerals.