2014 Experimental Vehicle Team

PSR helps to sponsor international award-winning St. Thomas Academy (St. Paul, Minn.) Experimental Vehicle Team. This is a record of their 2014 winning effort.

PSR helps to sponsor international award-winning St. Thomas Academy (St. Paul, Minn.) Experimental Vehicle Team. This is a record of their 2014 winning effort.

With 25,000 units shipped in January 2021, exports of vehicles grow 21.9 % compared with January 2020 and 24.2% compared with December 2020. The volume surprised ANFAVEA, which was expecting worse numbers because of the effects of the pandemic in the South American Countries, traditional destinations for Brazilian vehicle exports.

PSR Analysis: This result is positive compared to our initial forecast of a slow recovery of South American countries. On the other hand, the production in countries such as Argentina and Colombia has been affected by a shortage of raw materials, creating an opportunity for imports from Brazil in these countries, even with lower demand. PSR

Fabio Ferraresi is Director, Business Development-South America, for Power Systems Research.

BorgWarner said it will start producing battery systems for electric vehicles in Piracicaba-SP, Brazil, by Q1 2023 with declared annual capacity of 1,000 electric units.

The plant in Piracicaba formerly belonged to Delphi and was acquired by BorgWarner in 2020. The plant will receive a production line from Akasol, another company acquired by BorgWarner.

Singapore-based MVLLabs, the operator of car dispatch service TADA, has raised US$5 million. MVLLabs is a company that operates a mobility ecosystem based on the blockchain protocol. TADA, a no-fee car dispatch platform built on MVL’s blockchain, launched in Singapore in 2018.

In 2020 they are also expanding into Cambodia and Vietnam. MVLLabs plans to use the funds raised to facilitate continuous expansion and further develop the mobility ecosystem.

According to them, mobility data such as transactions, journeys, accidents and vehicle maintenance are recorded and connected within a single MVL ecosystem. Users can interact with the MVL ecosystem on the blockchain through connected services such as TADA and other upcoming services. Operating in Singapore, Cambodia and Vietnam, TADA has over 50,000 drivers and more than 500,000 users.

Source: BRIDGE (The original article was partially revised by the author.)

PSR Analysis: Unicorn companies in Southeast Asia have been raising large amounts of capital. Tech companies are solid. They are cleverly combining sophisticated business strategies with promotion to attract investors.

There has been a noticeable trend in the past for foreign companies with huge capital to invest in Southeast Asia, and the Southeast Asian governments have also been eager to attract factories in the region in anticipation of this. But now, in addition to that trend, homegrown companies are making their presence felt by challenging the local market. As COVID-19 is bringing globalization to a standstill, the trend of local companies growing as a local economic base will accelerate further.

Three-wheeled taxis with various names such as Tuk, Bajaj, Tricycle, etc. can be found in many cities in Southeast Asia. For example, there are about 22,000 registered tricycle taxis in Thailand. In the Philippines, there are an estimated 2.5 to 3 million tricycle taxis. However, air pollution due to exhaust emissions and noise pollution due to engine noise are two of the main problems, and there are calls for the adoption of EVs as a solution to these problems.

Several companies have carried out test deliveries of EV Tuk Tuks, but there have been a number of breakdowns in the past because of exposure to heavy rain during the rainy season. It will be interesting to see what strategies companies with no previous experience in vehicle development will adopt to enter this field, where durability is strongly demanded. PSR

Akihiro Komuro is Research Analyst, Far East and Southeast Asia, for Power Systems Research

We have been hearing a lot of talk and getting questions on the current status and the future of autonomous vehicles within the medium and heavy segment.

Early adopters of autonomous technology will likely be in the class 8 long haul segment followed by the bus and medium duty truck segment. Currently, the high cost of the technology can be better absorbed in class 8 long-haul truck applications.

The transition from level 0 to level 1 and 2 is happening relatively quickly due in part to the availability of the technology. Level 3 adoption is still a few years away and it is currently not legal to use on the highway. It will likely be 2027 or 2028 before we see small levels of level 3 commercial vehicles on the road.

Q. What is the current state of electric vehicle technology globally as well as the U.S.?

A. From a medium and heavy truck perspective, electric trucks are still in the early stages of testing, and it will still be a few years before we know if the current technology will be effective. Transit or city buses are much further along in the process since these are largely not for profit vehicles and have more dedicated routes that allow for more consistent recharge.

China is probably the furthest along with electric bus adoption with almost half of all medium and heavy buses produced being electric. While electrified bus adoption in North America and Europe is not nearly as strong as China, demand is increasing. In North America, natural gas buses (CNG and Propane) are currently the alternative fuel of choice. However, government mandates will likely force bus electrification over the next decade or so.

The global Outboard Marine Engine Market size is estimated at $5.54 billion in 2023, and is expected to reach $8.99 billion by 2035, growing at a CAGR of 4.1% during the forecast period, according to research by Power Systems Research.

The COVID-19 outbreak significantly impacted the boat manufacturing industry and caused a decline in recreational activities worldwide, which hurt outboard motor sales. However, in 2021, the market regained momentum due to the easing of restrictions. The market is expected to register healthy growth in the coming years.

There are generally three types of boat drives including inboard, outboard, and sterndrive. One obvious distinction among them is their placement of motor in the boat.

Market Overview. The global UTV/ATV market size was US$ 8.66 billion in 2021, with a compound annual growth rate (CAGR) of 6.13%. PSR forecasts the global market to grow to US$ 11.67 billion by 2026

The North American UTV/ATV market was valued at US$ 6.66 billion in 2021, and it is expected to reach US$ 8.50 billion in 2026, registering a CAGR of about 5.00% during the forecast period (2022 – 2026).

Applications. UTVs/ATVs were originally associated with sports and recreational activities. Application of these vehicles has diversified, and they are now being used in the agricultural sector and for patrolling, hunting, gardening, and other activities.

A recent application is the United States Army. The military has shown interest in acquiring UTVs/ATVs with features such as rapid transportation, the ability to carry nine fully armed soldiers, agility, and a minimum of 55 mph.

The pandemic bike boom boosted e-bike sales 145% from 2019 to 2020, more than double the rate of classic bikes, according to the market research firm NPD Group.

Research by Power Systems Research estimates the global e-bike market size at US$ 23.2B in 2022 and expects the market to reach US$ 78B by 2030, exhibiting a CAGR of 10.5%.

E-bikes are bicycles equipped with electrical motors for transforming electrical energy into mechanical energy to assist pedaling. They use rechargeable batteries that require minimum maintenance and provide power to the motor.

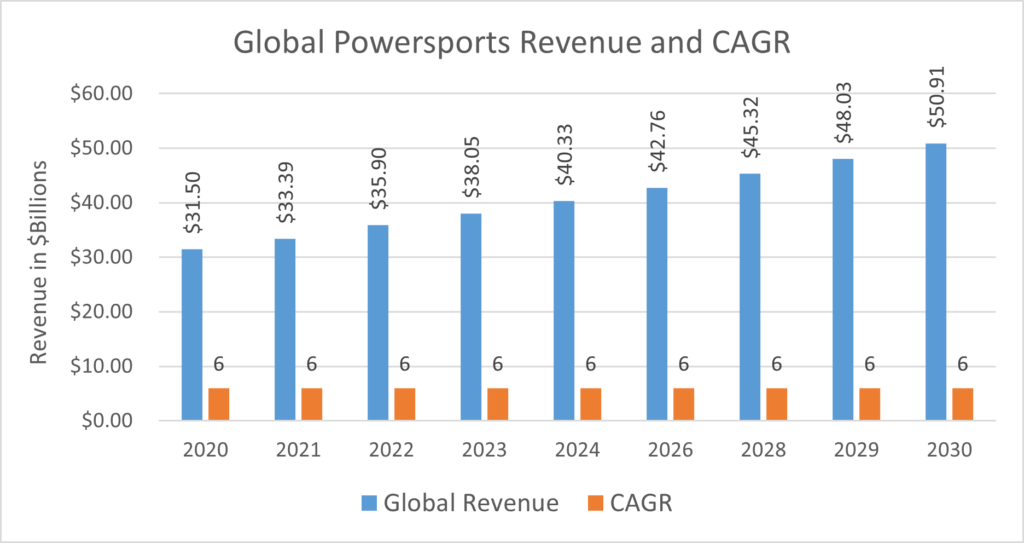

Power Systems Research is forecasting global revenue for the Powersports industry to grow from $31.5 billion in 2020 to US$ 50.91 billion in 2030, a CAGR of 6% over the forecasted period.

Drivers-of-Demand. There are many factors driving the global powersports market growth: