The Future of Commercial Vehicles. Perspectives for Brazil

Published in Automotive Business, August, 26, 2020

1. INTRODUCTION

The use of diesel in Commercial Vehicles and its alternatives has been studied and discussed globally over the past two decades. We have updated future trends annually based on the new platforms in our data and new models in development allowing us a 10-year horizon. In August 2019 we published an article on the subject for Automotive Business Brazil, which is now updating.

In the 2019 article we said that fossil diesel propulsion for commercial vehicles would be exposed to several alternatives and therefore the 20s decade would be a decade of significant changes, justifying yearly monitoring of the subject.

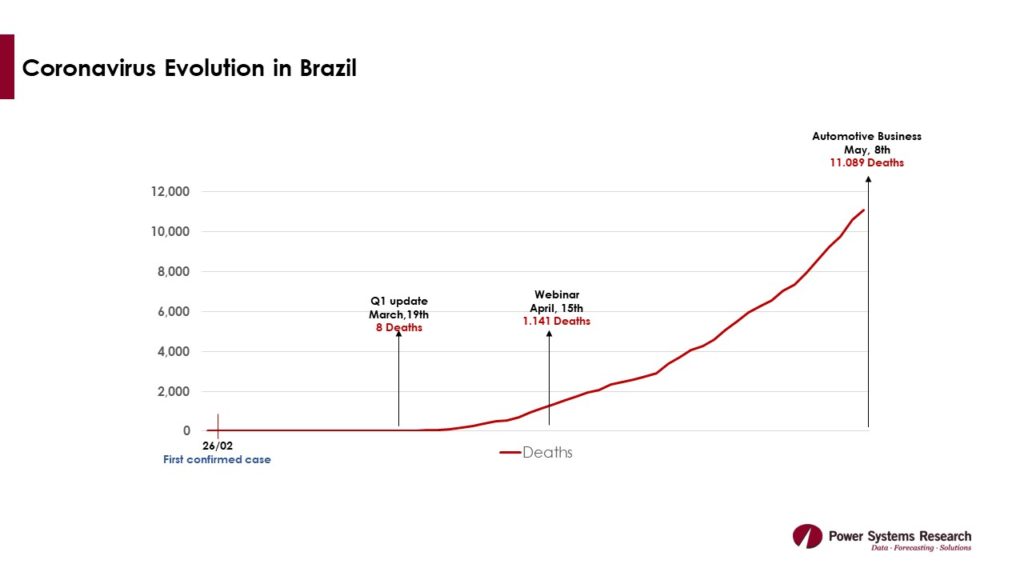

This whole range of studies was then impacted by COVID-19, a new event at the beginning of this decade that is another factor of change in this complex subject.