Published in Automotive Business, August, 26, 2020

1. INTRODUCTION

The use of diesel in Commercial Vehicles and its alternatives has been studied and discussed globally over the past two decades. We have updated future trends annually based on the new platforms in our data and new models in development allowing us a 10-year horizon. In August 2019 we published an article on the subject for Automotive Business Brazil, which is now updating.

In the 2019 article we said that fossil diesel propulsion for commercial vehicles would be exposed to several alternatives and therefore the 20s decade would be a decade of significant changes, justifying yearly monitoring of the subject.

This whole range of studies was then impacted by COVID-19, a new event at the beginning of this decade that is another factor of change in this complex subject.

2. COVID19

There is not a clear answer yet how the post COVID-19 world will look, but we can already identify some trends:

- Due to long quarantine periods, the world has had the opportunity to live with cleaner cities in terms of air pollution, which has become a wish. This aspect is quite unfavorable to diesel engines, mainly in metropolitan regions

- The price of oil decreased by around 65% in March 2020, returning to a value of $ 40 / barrel, 30% less than in 2019. This makes the operational cost of the Diesel solution even more competitive.

- The pandemic required changes in hygiene behavior, as well as in aversion to contaminants that could affect the respiratory system, as in the case of particulate from the combustion of diesel.

- Protection of the environment is no longer a concern of NGOs, but a concern of society and fuels from non-renewable sources, such as fossil diesel, will be scrutinized in this regard. The environmental issue will be on the agenda of all future trade agreements.

- The pandemic will cause an economic recession, impacting different regions differently, but certainly the global production of Commercial Vehicles.

- All OEMs have been affected in their cash and investment capacity, which tends to hinder spending on the development of new technologies.

- Logistics problems due to the long global supply chain should influence companies to develop a local and / or regional supply chain.

- Some countries heavily dependent on China supply over the past few years. Now these countries look for alternatives to reduce this dependence.

3. COMMERCIAL VEHICLE MARKET

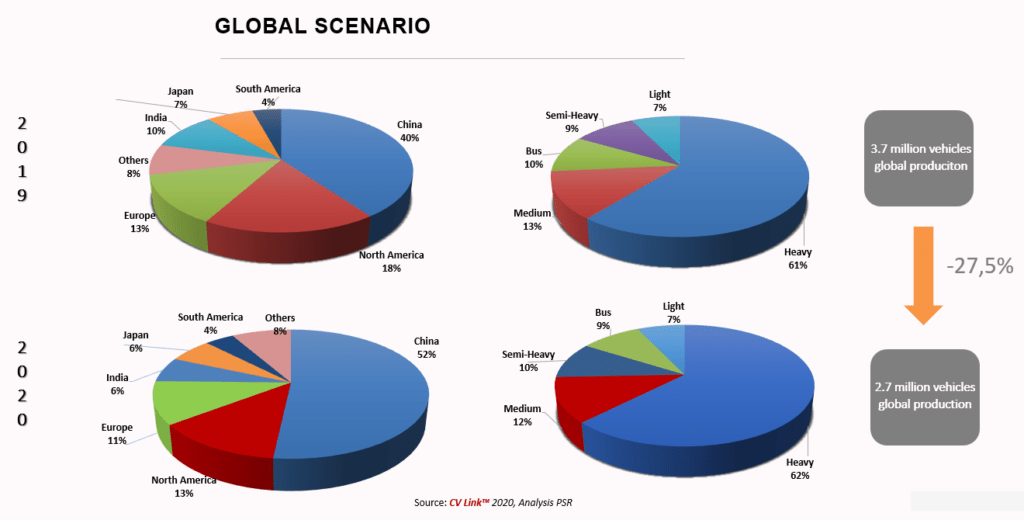

The Commercial Vehicle production market over 6-ton, current 2019 and 2020 forecast are shown here:

The impact of Covid-19 is expected to be in the order of 1 million vehicles, and China, due to the faster recovery, would be increasing the share of world production mainly due to the reduction of the share in North America. The bus segment is the one that is being impacted the most due to people contact restriction, while the heavy and semi-heavy segment is increasing participation due to relation with long distance transportation of goods.

4. TECHNOLOGICAL CHANGE DRIVERS

The changes to a new technology occur when we have the alignment of six basic drivers:

- Legislation. This is the most important driver for changes, since it represents requirements that must be met.

- Global Trends. This addresses the global movement and potential in the use of this technology

- Infrastructure. This driver includes installed items or items being installed to use this technology

- Proven Technology. In other words, technical and practical proof that this technology works in the applications it is intended for.

- Government Incentives. Usually, emerging technologies need scale in order to prove economic viability. Therefore, incentives are needed until this technology reaches scale in order to remain economically sustainable.

- Operating Cost. All costs are the costs involved, from acquisition, operation, maintenance and resale of the vehicle, that is, competitiveness.

5. LEGISLATION FOR COMMERCIAL VEHICLES

With regards to emissions, all major Commercial Vehicle producing regions have already adopted legislation equivalent to Euro VI, including countries that imports from Brazil such as Mexico and Colombia. Brazil will be the last of the largest producers to introduce this legislation through Proconve 8 in 2023, and even then, there are still requests from OEM groups for postponement to 2025.

Europe has already determined the entry of Euro VII, starting the transition from the last phase of Euro VI to start the first phase of Euro VII starting in 2025. All phases determine an increasing reduction in the level of emissions and in the quantity and size of particulate matter until zero emission in 2040. Euro VII shall be the standard to be followed by other regions.

Legislation on greenhouse gas emissions for commercial vehicles, or CO2 emissions, first started with EPA in the United States, setting targets for improving energy efficiency over time, based on 2010. More recently all major regions in the world already has initiatives to establish legislation for energy efficiency for Commercial Vehicles. Europe has already set a target of 15% reduction from 2025, and 30% from 2030. By 2025, all targets are expected to be defined in the main regions. In Brazil, these targets will only be established in 2027 and the introduction by 2032.

Finally, in terms of legislation for emissions of toxic products and CO2, the metropolitan regions have shown to be stricter in terms of reductions and implementation deadlines than the equivalent national legislation, as described below in the various countries / regions:

China

The entire fleet of urban buses should be converted into buses powered by clean energy, and this concept includes natural gas and electric buses.

Beijing: The entire city will switch to clean energy by the end of 2020. Electric buses will cover 100% of the central region, and the population of electric buses in the entire city will be 50% by the end of 2020.

Shanghai: The entire fleet of city buses will meet the clean energy plan before 2020.

Shenzhen: This city switched to electric buses in 2017.

Guangzhou: All buses will be electric by the end of 2020.

Other cities: Many other provinces have already published electric bus schedules. Apparently, the fleet of electric city buses will be around 50% across China by the end of 2020.

This huge population of city buses will also have other clean energy alternatives, such as natural gas. Either way, 80% of city buses are expected to be electric by the end of 2021.

North America

In the United States, Los Angeles will be the first “zero emission” city, with the entire bus fleet being converted to electric in 2030. San Francisco has the same requirement for 2035, with New York, Seattle and other California metropolitan areas in 2040.

For the entire State of California, targets require 5% of new commercial vehicles with zero emissions starting in 2024, with this percentage increasing over time to reach 100% in 2045. This means that in 2032, when Brazil should start implementing this regulation, California will already have a 40% percentage.

In Canada, the main urban centers will begin the transformation of buses for electric propulsion from 2025, being mandatory by 2040.

Europe

London already imposes a traffic ticket for vehicles that do not meet Euro VI driving in metropolitan areas. Athens, Paris, Madrid, Rome will have restrictions on diesel vehicles from 2025. From 2030, Paris, London, Barcelona, Copenhagen, Milan, will have restrictions on vehicles powered by fossil fuels.

In 2019, the European Union parliament approved the “Clean Vehicle Transportation” directive, which establishes that all propulsion of new urban transport vehicles, whether buses or new trucks, must use one of the following alternatives: Hydrogen, Natural Gas, Biogas, Liquid Biofuels , hybrid and electric. This directive is expected to become legislation as of August 2021.

Latin America

São Paulo, Brazil. As of 2028, legislation requires 50% of buses using non-fossil fuels, 80% NOx reduction, 90% particulate reduction, and from 2038 propulsion using non-fossil fuels will not be allowed, and the reduction required for NOx and particulate matter is 95%.

Bogota, Colombia. Euro VI legislation was implemented in 2019 for the metropolitan region and in 2020 for the entire country. Initiatives to acquire 1,400 buses were launched in 2019, 700 Electric and 700 powered by Natural Gas.

For 2020, another 600 electric buses are planned. 200 Euro VI Diesel buses have just been purchased from a Brazilian company, but the chassis must be imported from Sweden as Euro VI technology is not yet available in Brazil.

Santiago, Chile. Euro VI legislation was implemented in 2019. It has a fleet of 200 electric buses, and 400 will be added in the coming months. A target of 25% electric buses has been set for 2025, with a goal of 100% in 2030, depending on competition. Chile competes with Colombia, as the country with the largest fleet of electric buses in Latin America.

Buenos Aires, Argentina. “Clean City” plan being introduced. Tests are being carried out with Electric and Natural Gas buses, to define the future direction.

Greater restrictions on the use of diesel engines, as well as internal combustion engines, are associated with metropolitan areas.

Additionally, we have the following global trends:

• OBD systems are increasingly able to control each component of toxic emission that is being emitted by the vehicle.

• Emission measurements will be increasingly checked with the vehicle in service.

• Especially regarding CO2 emissions, there are several studies to standardize that measurements that are carried out along the production chain, from the fuel source to the exhaust emission. It is a complex calculation, which does not guarantee the reduction of CO2 in metropolitan regions. As an example, in the São Paulo metropolitan region, the use of non-fossil fuels does not reduce the CO2 emission, because the fuel originates from vegetable plantations in the Midwest of the country.

In summary, the world is moving quickly to reduce the levels of toxic and CO2 emissions. Brazil is late in relation to all the main regions including Latin America. Therefore, postponing the Euro VI would not be appropriate at this time, and would be negative to the country’s image in relation to commitments to the environment, and would reduce its export opportunities. As for the legislation of the city of São Paulo, we understand that it should be revised considering only the aspect of reducing emissions, whether toxic or CO2, without considering the source of the fuel.

6. FUELS AND POWERTRAINS ALTERNATIVE TO DIESEL

Due to the directions established by the legislation described above, all regions have sought alternatives to the use of diesel engines in Commercial Vehicles.

The difficulty in replacing diesel propulsion is that it is a highly efficient alternative, available in global terms, and still the one with the best economic viability. With the energy efficiency laws, other technological resources such as new materials for weight reduction, aerodynamic improvements, reduction of drag tires, improved efficiency of the powertrain itself, will make Diesel vehicles even more economical.

In addition, the infrastructure is already established, and no investment is required for the transport network.

On the other hand, legislation related to metropolitan regions will make the future of fossil diesel propulsion quite difficult, therefore several alternatives are already in operation in some regions and being tested in others. The main ones are:

Biodiesel

This alternative already used as a percentage addition to fossil Diesel. In Europe, the addition is 10%, and in Brazil it was currently 12% until recently and at the moment it has been reduced to 10% with a forecast of 15% in the introduction of the P8.

Various agricultural products are used to produce Biodiesel. In Brazil, the predominant source is soybeans, the product being a mixture of esters, which are not similar to the typical organic chain of fossil diesel, producing more NOx as the Biodiesel content increases, requiring a greater amount of Urea, and thus increasing the operational cost.

The B15 solution for the introduction of Proconve P8 still requires testing, which means that the existing solutions for Euro VI will not necessarily be the ones that will be applied for P8. From the point of distribution infrastructure it is perfectly aligned with the distribution of fossil diesel. Brazil recently reached the B12 level, which was soon reduced to B10 due to the low supply of Biodiesel.

Until last year, the price of Biodiesel was very competitive with fossil diesel, but competitiveness and availability follow fluctuations in commodities, in the case of soybean on the one hand and oil on the other.

HVO

Also obtained through hydrogenated vegetables, which makes the product very close to fossil diesel, with the advantage of being more uniform in terms of hydrocarbon mixture.

In this way it is better than fossil diesel in terms of emissions and allows it to be used in any percentage as an addition to diesel or even pure without any implications for diesel engines.

There is no production scale in Brazil yet, and the 1st plant in South America is being built in Paraguay with the destination of export to the United States. This would be one of the fuels that should have some subsidy to gain scale and competitiveness, since it is technically perfect green diesel.

Ethanol

Widely used in the Flex option in light vehicles, the option for heavy vehicles and engines in the Otto cycle is economically unfeasible. New enzymes are being developed for second generation ethanol which would make ethanol more competitive. In any case, the great future of ethanol seems to be in applications for Light Vehicles, whose global scale exceeds 90 million vehicles.

In Commercial Vehicles, ethanol can be an excellent source of hydrogen for fuel cells, thus avoiding the need for a hydrogen distribution infrastructure since the current ethanol distribution infrastructure would be used for gas stations or gas generation centers of hydrogen from ethanol. Then vehicles would be supplied with hydrogen at these stations.

Biogas

Composed mainly of methane, biogas is made from organic waste, which makes the alternative highly attractive from an environmental point of view. The biggest obstacle is the investment in infrastructure for generation and distribution. In Europe, this alternative is developing rapidly through the existing structure for both the collection and treatment of organic waste, as well as the distribution infrastructure.

In Brazil, the legislation is making it stricter regarding the existence of garbage deposits, which increases the attractiveness of biogas plants.

Natural Gas

Composed mainly of methane, but in higher concentration than Biogas, the source of generation is fossil, and it may or may not be associated with oil. Despite the aversion to fossil fuels, Natural Gas represents a very clean combustion product, requiring much less treatment than Diesel to reach the Euro VI level. Depending on the efficiency of the engine, it can also generate less CO2 / km than the diesel equivalent.

In Brazil the biggest current problem is price and distribution infrastructure. While in the United States the price is in the order of US$ 3 /million BTU, in Brazil using the same unit the price is in the order of $ 12 and in South of Europe $ 8. China has prices similar to those of Brazil, but should reach levels in South of Europe at the end of the implementation of the pipeline from Russia.

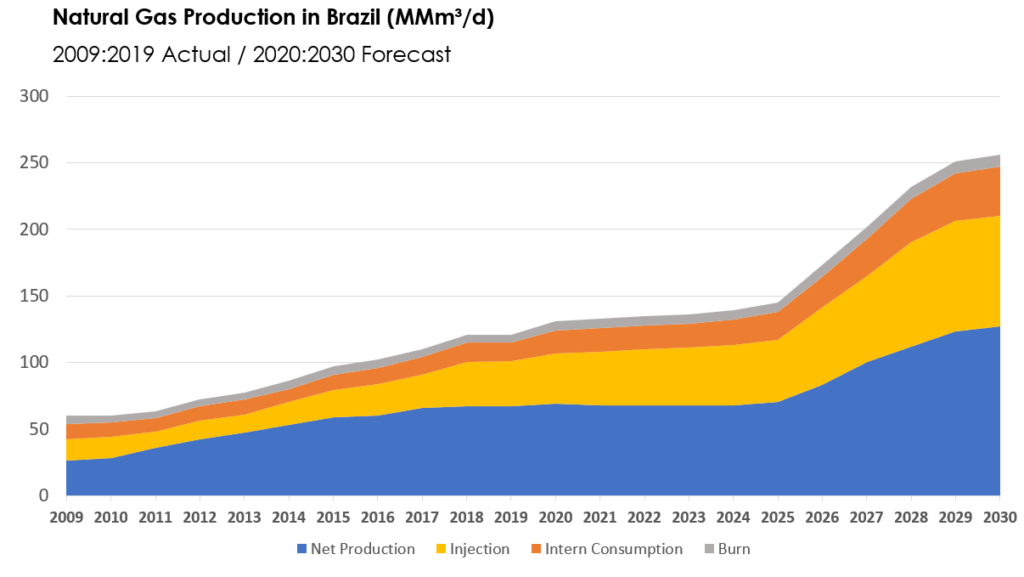

Despite this, with the deregulation of the sector, the future of gas in Brazil seems to be very promising. By the end of the decade, Brazil should achieve production of 7.5 million barrels of oil equivalent / day, going from the current 9th position to the 4th oil producer in the world.

The production of natural gas follows a proportionally equivalent growth, as shown in the following figure:

The infrastructure for use is being planned, with the state of São Paulo ahead with an expected investment of BRL $ 22 billion in gas pipelines throughout the state, tripling the current network from 16,000 km to 48,000 km over the next 10 years. It expects the price to be reduced at least to the level of $ 7 USD / million BTU, making Natural Gas a highly attractive option.

We could also consider that interconnection with biogas pipelines would be technically possible, making the solution more environmentally attractive.

In China, Europe, the United States and in some Latin American countries, natural gas is considered a clean energy source due to the low level of emissions

Additionally, Natural Gas is an even better source of hydrogen than ethanol, so it could also be a hydrogen generator for fuel cells.

In addition to the horizon of Brazil, we can consider the significant reserves of natural gas in South America, which makes the option very attractive in terms of the continent.

Some OEMs in Brazil have already developed very efficient gas engines and are meeting the growing demand for gas buses in Latin America.

Hybrids

Considering electric hybrids, that is, Diesel-Electric propulsion, the tests prove to be a very interesting alternative depending on the drive cycle. With the tendency for buses to travel on their own corridors, the option becomes less attractive, as we will analyze together with the electric option.

Electric

Currently, it is the only solution to meet “zero emission”, and therefore it is the main trend from an environmental point of view. On the other hand, the operating cost considering acquisition cost, operation, battery charge time, resale cost, scrap cost, makes the option non-competitive.

Battery costs have been reduced by 80% in the past 10 years, just as battery life has increased and charging time has been reduced.

Even so, based on the base price in Brazil of BRL $ 600,000.00 for a 12m – 85 seat bus with a Euro VI Diesel engine, the Hybrid equivalent would be in the range of BRL $ 800,000.00, while the Electric plug-in would be above R $ 1,200,000.00.

In addition, investment in plug-in infrastructure would be necessary to supply a fleet of 16,000 buses in a metropolitan region such as São Paulo, and the same type of investment when the vehicle is resold to another region after being used in São Paulo.

The entry of a new technology in these conditions requires incentives, or an increase in the cost of the ticket, things that are not feasible at the present time in Brazil, and we believe that the country has better solutions to meet future trends.

Finally, China has led the technology and production volume of electric buses, but the world is going through a time of reviewing strategies regarding extreme dependence on China.

Fuel Cell

Alternative has always been considered as the technology of the future. The idea of generating electrical energy from H2, with only H20 steam emitting, inspires environmentalists and engineers who try to find an alternative to the high energy density of Diesel and reap the benefits of the electric propulsion that follows after the power generation stage. The benefits of low noise and simplicity of torque distribution are the same as Electric propulsion. However, viable solutions for the market have not yet been reached. It is still debated whether the transformation of Ethanol or Gas into H2 will be done by technology embedded in the vehicle or supplying the vehicle with H2 supply. In this case, of a vehicle supplied with H2, the restrictions of H2 distribution and security of supply are still explored. The cost of technology is still a major unknown, not least because the market technology has not yet been defined. More recently, the high cost of electric vehicles, the necessary plug-in infrastructure, uncertainties about the economic viability of electric vehicles, and the recent investment limitations caused by COVID19, have created a more favorable fuel cell environment. In the USA, Nikola already presents a proposal to the market and OEMs in Japan have plans to develop this technology, no longer on an experimental or research basis, but for the market. As we described earlier for ethanol and natural gas, they are abundant natural resources in Brazil that can be facilitators for the success of the technology here, depending on the decisions for alternatives for generation and distribution of H2. In addition, the price of oil and oil products was sharply reduced, which also impacts the reduction in the cost of hydrogen. In this way, this solution, once long-term, presents itself as a probable reality even in this decade.

7. COMMERCIAL VEHICLE FORECASTS – current 2019/2030 forecast

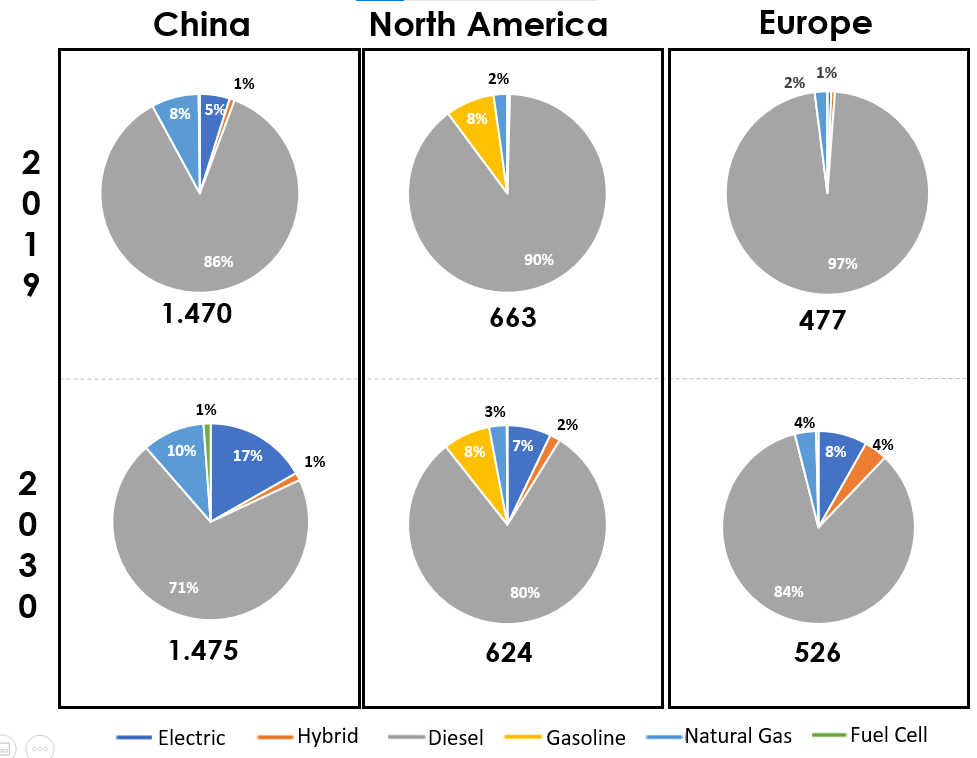

Based on the items described above, and forecasts for vehicles and platforms that are already part of our Commercial Vehicle databases, we can predict a reduction in the use of diesel engines in commercial vehicles over the decade, from a value today of 90 % of applications to around 70% at the end of the decade.

This trend of permanence of Diesel as the main propulsion is associated with application in commercial vehicles for long distance transportation, which are most applications as described in item 3 – Market.

The biggest driver for the decline in the use of diesel propulsion is associated with environmental legislation in metropolitan regions. Hybrid and Electric propulsion should be the biggest substitutes for Diesel propulsion, followed by Natural Gas and / or Biogas.

The growth of each of the technological options for diesel in each region depends a lot on the energy matrix and geopolitical strategies of each region.

As an example, in China coal is responsible for 72% of the energy matrix and thus the strategy to develop electric vehicles as well as the supply infrastructure makes perfect sense, so that China is, and will continue to be, the largest producer of Commercial Vehicles, dominating the entire supply chain, including batteries. There is also a parallel strategy to replace coal with natural gas from Russia, which also drives the replacement of Commercial Vehicles with diesel propulsion by Natural Gas.

The situation in Brazil is completely different. We have one of the cleanest energy matrices in the world due to hydroelectric, ethanol, biodiesel, the substantial growth of wind and solar generation, so that approximately 50% of the energy matrix comes from renewable sources. In this respect, the legislation of the city of São Paulo does not make much sense regarding the prohibition of fossil fuels, since we will be one of the largest producers of natural gas in the world, and all regions more developed in terms of legislation have considered natural gas as clean energy.

These geopolitical conditions determine a differentiated growth of new technologies in the main regions producing commercial vehicles, as shown in the following figures:

Commercial Vehicles – Production Volumes (000) units

Current 2019/2030 Forecast

These trends do not yet contemplate the recent acceleration of Fuel Cells, so our expectation is that over the decade they will become more important.

8. SUMMARY AND CONCLUSIONS

• Diesel will continue to be the main propulsion technology for commercial vehicles in long-distance transport applications for this decade.

• HVO has all the conditions to be the best green diesel alternative.

• In metropolitan areas, diesel propulsion tends to be replaced by electric propulsion or natural gas / biogas, depending on the geopolitical conditions of each region.

• China is driving growth in the use of Electric buses in the world, through scale and domain of supply chain and technology, as well as the entire plug-in infrastructure is already installed in the country.

• Considering Brazil’s current and future energy matrix, natural gas is an excellent alternative for metropolitan regions until technologies such as Electric or Fuel Cells become feasible.

• Fuel cells have developed rapidly and are likely to be the best alternative in this decade. It would be a great solution for Brazil. PSR

Carlos Briganti is Managing Director Power Systems Research South America