Introduction

Our team at Power Systems Research, as a lead global Market Intelligence Company and specialized in Propulsion Systems and Powertrain for Vehicles and Equipment, is frequently asked about the future of Diesel Engines.

It is impossible to provide a complete answer for this question due to the wide range of applications, as well as the excellent performance and versatility of Diesel Engines.

Thus, in this article we focus on the Diesel Engine application in Commercial Vehicles in metropolitan areas, and more specifically, in Urban Buses.

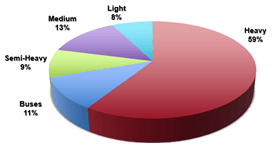

From our databases CV Link ™ and OE Link ™ we see that 3.7 million Commercial Vehicles are expected to be produced in the world in 2019. These will be distributed in the main regions and applications as shown in these charts.

Source: CV Link™ 2019, PSR Analysis

During the next decade, this segment will go through important technological changes. Several options of powertrain and propulsion systems and the timing of each implementation will be affected by the drivers we describe later in this article.

Technology Change Drivers

The adoption and development of new technologies will be caused by these six basic drivers:

- Legislation. One of the most important drivers of changes.

- Global Trends. Global product developments using this technology will appear in local markets.

- Infrastructure. Changes must be implemented to take advantage of the new technology.

- Proven Technical Feasibility. Feasibility and reliability for the applications using the technology must be proven before they are widely accepted.

- Government Incentives. New technologies rely on incentives before there is sufficient volume to reach economical feasibility and self-sufficiency.

- Operational Cost. Total Cost of Ownership, which includes acquisition, operation, maintenance and vehicle resale, must be competitive.

Legislation for Commercial Vehicles

With regards to emissions, all the main Commercial Vehicles producing regions have adopted–or will adopt in the short-term–legislation equivalent to Euro VI. Brazil will be the last of the major producers to introduce this technology with Proconve P8 in 2023.

The legislation on Green House Gas (GHG) for Commercial Vehicles started in USA with the EPA setting goals for energy efficiency with a 2010 emissions timeline. Today, all main producer regions have initiatives to establish regulations for GHG emissions for CV, and we expect all goals to be set by 2025. In Brazil, these goals will be set in 2027.

Lastly, both for GHG and emissions, the metropolitan regions have demonstrated stricter rules for reduction targets and terms when compared to national legislation, as we describe to several countries and regions.

- China. All urban bus fleets will be converted to electric power by 2022 in Beijing, Shanghai, Guangzhou, Shenzen and the Pearl River Delta region.

- North America. Los Angeles will be the first Zero Emission City, with all bus fleets converted to electric by 2030. San Francisco will follow the same requirement five years later, in 2035. In Canada, main urban centers will begin the transformation to electric propulsion from 2025 on, being mandatory by 2040.

- Europe. London already has restricted areas for vehicles that don’t meet Euro VI circulating in Metropolitan Areas. Other urban centers, such as Madrid, already have different levels of emissions restrictions in different areas. Athens, Paris, Madrid, and Rome will have Diesel Engine restrictions beginning in 2025. Paris, London, Barcelona, Copenhagen and Milan already have set policies prohibiting fossil fuel propelled vehicles in urban centers after 2030.

In addition, the parliament of UE is about to establish the goal of 25% of new buses being electric by 2025 and 75% after 2030. - South America. From 2028 on, the legislation of São Paulo, Brazil, requires 50% of buses with non-fossil fuels, and a reduction of 80% NOx and 90% of particulates. From 2038 on, 100% non-fossil fuel propulsion will be required, NOx and particles reduction must be higher than 95%.

In Bogotá, Colombia, Euro VI legislation is already in place for 2019 for metropolitan regions. In 2019, 1400 buses were bought for fleet renewal and expansion, with 700 fueled by Natural Gas and 700 by electricity. There is a forecast for other 600 electric buses to be acquired in 2020. - Legislation Euro VI was implemented in Santiago, Chile, in 2019. The fleet already has 200 electric buses and 400 will be acquired by the end of 2019. Santiago has a goal of 25% electric buses in 2025, and aiming for 100% in 2030, depending on cost competitiveness of this technology.

The “Clean City” plan has been set and is in the implementation phase in Buenos Aires, Argentina. Now, it is time of the evaluation Natural Gas and Electric Buses in order to define future directions in regulations.

These initiatives demonstrate higher restrictions on Diesel and other IC engines in Metropolitan areas.

Alternative Fuels and Propulsion Systems

Due to the direction set by the regulations described above, all regions are developing alternatives to the use of diesel engines in commercial vehicles.

The challenge on replacing diesel propulsion is the high efficiency, global range and yet economically feasible alternative. With energy efficiency legislation, other technological features like new weight reduction materials, aerodynamic improvements, tire drag reduction, improved powertrain efficiency will make Diesel vehicles even more economical.

In addition, the infrastructure is already in place, and no investment is required for the transportation network.

On the other hand, legislation related to metropolitan regions will make the future existence of fossil diesel propulsion very difficult, and therefore several alternatives are already in operation in some regions and being tested in others. The main ones are:

- Biodiesel. Alternative already used as complement in lower percentages to fossil Diesel. In Europe the addition is 10%, and in Brazil is currently 11% with a forecast of 15% in the introduction of P8. Various agricultural products are used for biodiesel production. In Brazil, the predominant source is soybean and the product being a mixture of esters, which are not similar to the typical organic chain of fossil diesel, complicating the propulsion solutions as the biodiesel content increases.

Thus, the B15 solution for the introduction of Proconve P8 still requires testing. The existing Euro VI solutions will not necessarily be the ones that will be applied to P8. From the point of distribution, infrastructure is perfectly aligned with the distribution of fossil diesel. In the past, the addition of Biodiesel meant a cost increase, but with currency devaluation and an increase in the price of fossil diesel, currently the addition of Biodiesel does not affect the final cost of fuel.

- HVO. Also obtained through hydrogenated vegetables, which makes the product very close to fossil diesel, with the advantage of being more uniform in terms of hydrocarbon mix. The cost of production, scale and distribution are question marks and potential barriers to using HVO, while HVO enthusiasts claim the only barrier is lack of technical specification and regulations.

- Ethanol. Widely used in the flex fuel option in Brazil on light vehicles, the option for heavy vehicles and engines in the Otto cycle is economically unviable. Eventually the economic viability could be improved with the ethanol of 2nd generation and super sugar cane development. However, the great future of ethanol seems to be associated with light vehicle applications, where global scale exceeds 90 million vehicles.

- Biogas. Composed mainly of methane, the generation is made from organic waste, which makes the alternative highly attractive from an environmental point of view. Biggest obstacle is the investment in infrastructure for generation and distribution. In Europe this alternative is developing rapidly through the existing structure for both collection and treatment of organic waste as well as the distribution infrastructure.

- Natural Gas. Also composed mainly of methane it is also a fossil fuel, associated or not with petroleum. Despite aversion to fossil fuels, Natural Gas represents a very clean combustion product, requiring far less treatment than Diesel to reach the Euro VI level. Depending on engine efficiency, it can also generate less CO2 / Km than the diesel equivalent.

In Brazil, the main barrier is price and distribution infrastructure. While in the United States the price is around $ 4 / million BTU, in Brazil using the same unit the price is around $ 12 and in Western Europe $ 8. China has similar prices to Brazil but should reach levels of Western Europe by the time the pipeline from Russia is implemented.

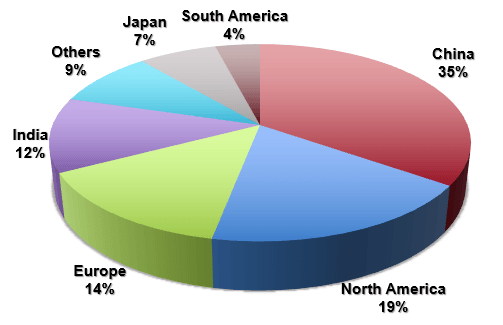

Despite these factors, with the deregulation of the sector, the future of gas in Brazil is very promising. By the end of the next decade Brazil should reach production of 7.5 million barrels of oil equivalent / day, going from the current 9th position to 4th oil producer in the world.

Natural gas production follows proportionally equivalent growth as follows:

Source: EPE 2018

The infrastructure for use is planned, with the state of São Paulo ahead with an investment forecast of $ 5 billion in pipelines throughout the state, tripling the current network from 16,000 km to 48,000 km over the next 10 years. It expects the price to be reduced to at least $ 8 USD / million BTU, making Natural Gas a highly attractive option.

We could also consider that it would be technically possible to interconnect with biogas pipelines, making the solution more environmentally attractive.

Beyond Brazil’s horizon, we can consider South America’s significant natural gas reserves, which makes the option quite attractive in terms of the continent.

- Hybrids. Considering the electric-hybrids, or diesel-electric propulsion, the tests show that it is a very interesting alternative depending on the drive cycle. With the trend for buses to travel their own corridors, the option becomes less attractive, as we will look at along with the electric option.

- Electric. It is currently the only solution to meet “zero emission” (tank to wheel), and therefore is the main trend from an environmental point of view. On the other hand, the operating cost taking into consideration acquisition cost, operation cost, battery charge time, resale cost, scrap cost makes the option uncompetitive.

Battery costs have been reduced by 80% over the last 10 years, as life has increased, and recharging time has been reduced.

Still, based on the base price in Brazil of $ 150,000 for a Euro VI Diesel 12m – 85 seat bus, the Hybrid equivalent would be in the range of R $ 200,000, while the Electric would be above R $ 300,000.00.

In addition, investment in plug-in infrastructure would be required to supply a fleet of 16,000 buses in a metropolitan region such as Sao Paulo, and the same type of investment when the vehicle is resold to another region after being used in Sao Paulo.

Introducing a new technology under these conditions requires incentives, or increased cost of ticket, things that are not feasible at the present time in Brazil.

- Fuel Cell. This is an alternative considered highly promising for the future, but still needs technology maturity to prove what would be the best alternative for hydrogen generation, and then defining and installing the appropriate infrastructure for distribution.

Forecast for Diesel Engines – 2018 – 2030

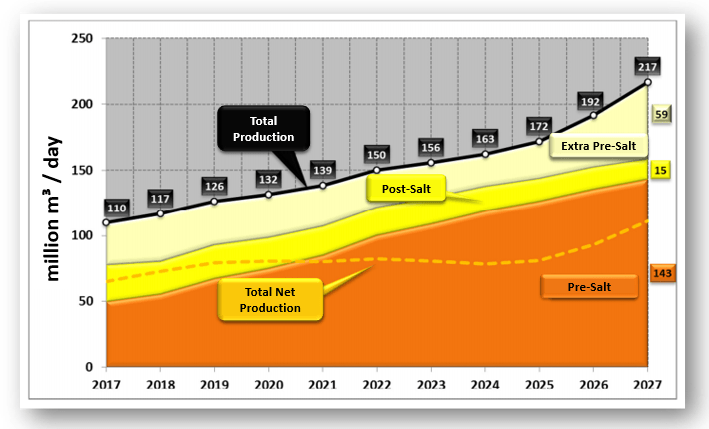

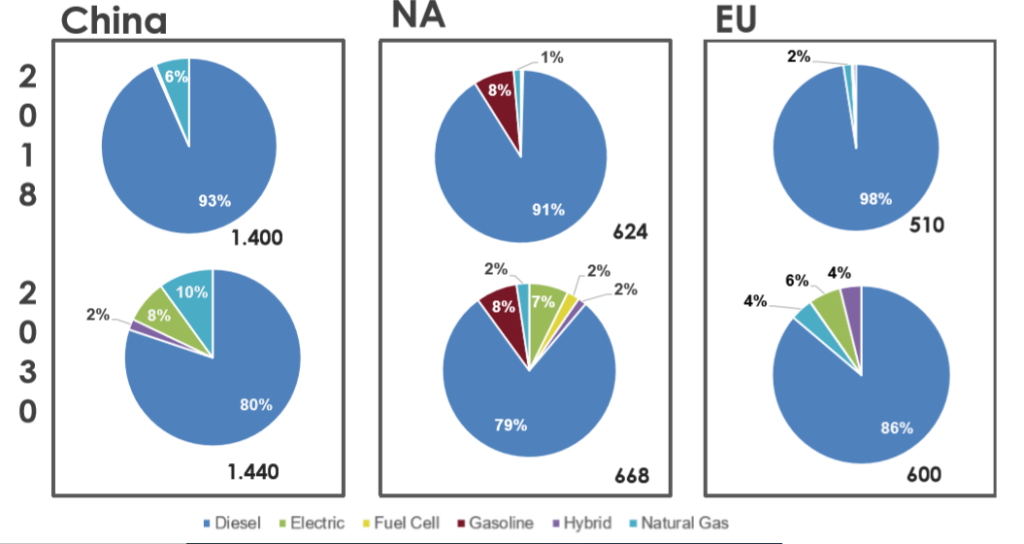

Based on the trends previously described and the vehicles platforms forecast already part of our commercial vehicle databases, you can see an evolution of the use of diesel engines in commercial vehicles as shown below:

% Diesel Propulsion Reduction

As may be noted, over the next decade there will be a decline in the use of diesel propulsion in commercial vehicles, but it should remain the dominant technology in over 70% of applications. The trend is associated with commercial applications for long distance transportation, which are the main applications described in the introduction (item 1) of this article.

The major driver for the decline in diesel propulsion use is associated with environmental legislation in metropolitan regions. As Hybrid and Electric propulsions registered as major substitutes for Diesel propulsion, followed by Natural Gas and/or Biogas.

The growth of each of options to Diesel in a specific region depends greatly on the energy matrix and geopolitical strategies of each region.

For example, in China, coal accounts for 72% of the energy matrix and thus a strategy for developing electric motors as well as fuel supply infrastructure makes perfect sense, so China is, and remains, the largest producer of electric commercial vehicles, dominating the entire production chain, including batteries. There is also a parallel strategy to replace natural gas from Russia, or also to push the exchange of diesel-powered commercial vehicles for Natural Gas.

The situation in Brazil is completely different. Brazil has one of the cleanest energy matrices in the world in terms of hydroelectric, ethanol, biodiesel, substantial growth in wind and solar generation, so that approximately 50% of the energy matrix comes from renewable sources.

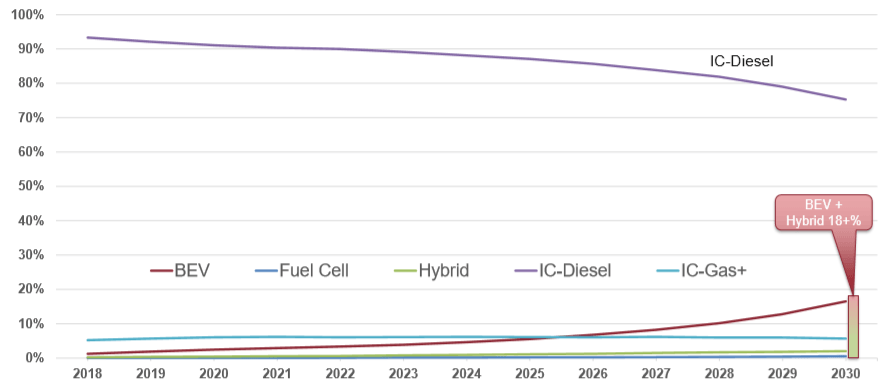

These geopolitical conditions drive differentiated growth of new technologies in major commercial vehicle product regions, as shown in the following figure.

Commercial Vehicles – Production Volumes – (000) units

2018 Actual / 2030 Forecast

SUMMARY AND CONCLUSIONS

• Diesel will remain the leading propulsion technology for commercial vehicles in long-haul transportation applications for the next decade.

• In metropolitan regions, diesel propulsion tends to be replaced by electric propulsion or natural gas / biogas, depending on the geopolitical conditions of each region.

• China is driving growth in the use of Electric buses worldwide, through scale and mastery of the entire production chain and technology as the plug-in infrastructure is already installed in the country.

• Given Brazil’s current and future energy mix, natural gas is an excellent and promising alternative until technologies such as Electric or Fuel Cells become technological or economic feasible. PSR

Carlos Briganti, is Managing Director, Power Systems Research América do Sul info@powersys.com