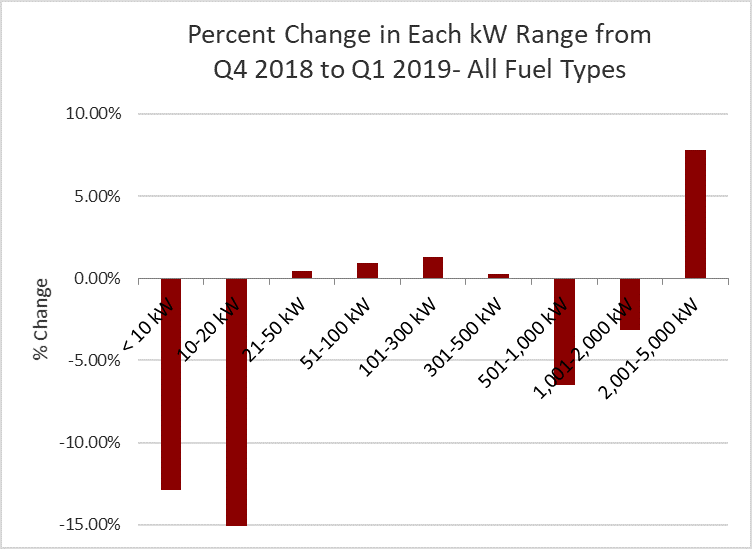

SUMMARY: Gen-set sales in Q1 2019 declined 13.6% from Q4 2018, largely due to an unusually steep drop in sales of portable gen-sets. Sales were anemic between 21kW and 500kW and declined in the 501-1000kW and 1001-2000kW ranges by more than any other Q1 in the last five years.

Within portables, diesel sales actually overperformed their history with 0% growth, while sales of natural gas gen-sets in the <10kW and 10-20kW ranges declined by 13-15%. On a Year-on-Year basis, overall unit sales for Q1 2019 were still up 2.6% compared to sales levels in Q1 2018. This is the first quarter since the hurricane season of Q3 2017 that has not seen double-digit YoY growth, and it is much more in line with the low single-digit fluctuations that occurred between 2013 and Q2 2017.

The data comes from the proprietary PowerTrackerTM series of syndicated surveys conducted each quarter by Power Systems Research. A total of 1,400 interviews are completed each quarter with gen-set dealers and distributors, businesses and households across North America.

The decline in sales in Q1 was due primarily to the sharp drop in gaseous (gasoline and natural gas) gen-sets in the <10kW and 10-20kW ranges. While gaseous gen-sets typically do drop by 5-9% in each of those ranges in Q1, the declines this quarter were almost double the norm, at 13% and 15.5% down, respectively. Gaseous gen-sets actually overperformed in the mid-ranges of 51-100kW, 101-300kW, and 300-500kW with mid-single-digit growth. The highwater mark for diesel gen-sets was their 0% growth in the <10kW and 10-20kW ranges, which typically decline in Q1. In the mid-ranges, diesel gen-sets showed mid-single-digit declines, cutting a path down the middle of Q1 performances over the last five years, which included dips as large as 10% and growth up to 5%.

Dealer inventory levels were about flat in Q1 2019 compared to the previous quarter. This leaves inventories 4.3% higher than Q1 2018. Since 2012, it has been typical to see 5-10% growth in inventories, but while 4.3% is historically modest, it is more normal than the slight dip in Q3 2018 and 2.7% growth in Q4 2018.

As part of our PowerTrackerTM series, we also monitor gen-set sales trends by application. As was mentioned, portable sales took an unusually steep dive this Q1. Standby sales also showed a sharp correction after two outstanding years of growth, falling nearly 12% in the single largest QoQ drop in the last five years, and almost doubling the next-poorest Q1 performance for standbys in that period. There were also significantly fewer dealer comments about demand for standbys this quarter. We will be watching to see if that means the impact of the Q3 2017 hurricane season is finally fading from consumer memory. Whether or not that is the case, we do not expect sales to return to the pre-2017 baseline, given that we still saw solid overall growth this quarter, even with the poor performance of portables and standbys, and adverse seasonal effects.

METHODOLOGY: Since 1998, Power Systems Research (PSR) has been continuously maintaining its PowerTrackerTM series of syndicated surveys, conducting 1,400 interviews each quarter among three key respondent groups in North America: gen-set dealers and distributors, businesses and households.

We conduct 200 interviews each quarter among dealers and distributors; the focus of this survey is on recent sales and market observations for the current quarter as well as expectations for the coming quarter.

Our Business Consumer survey consists of 900 interviews per quarter among a wide cross section of businesses to gather their input concerning ownership, usage trends and motivating factors for purchase, including any concerns about the reliability and availability of electric power.

Finally, our Household Consumer survey consists of 300 interviews per quarter to learn more about gen-set ownership trends among households and monitor the likelihood of a gen-set purchase.

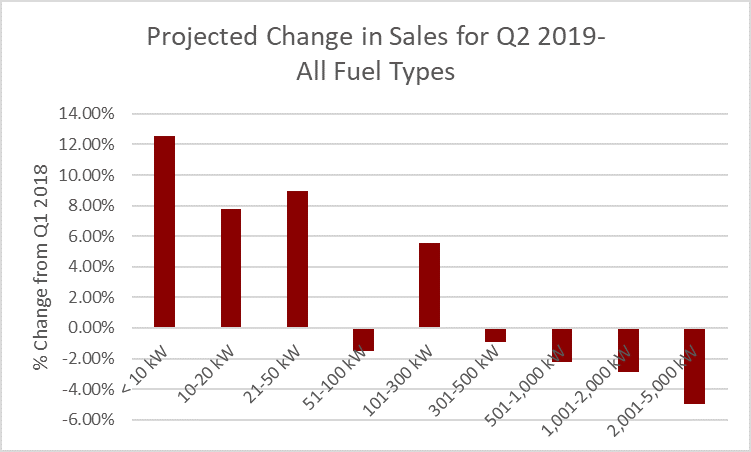

Dealer/Distributor Outlook for Q2 2019

Dealers and distributors expect sales in Q2 2019 to increase in the lower ranges and remain roughly flat in the mid- and high-ranges, except for 5% growth expected in the 101-300kW range. Going into the camping and RV season, dealers project 13% growth for <10kW gen-sets and high-single-digit growth in the 10-20kW and 21-50W ranges. They project this growth to be driven by gaseous gen-sets and are making atypically gloomy forecasts for diesel gensets in those ranges, reaching up to a double-digit drop in the 10-20kW range. The flat forecast for the >50kW ranges is broadly consistent across fuel types, with the exception that dealers expect gaseous gen-sets in the 101-300kW to increase sales by about 5% and decrease by about 5% for diesel gen-sets in that range.

When asked, “Why do you expect sales to change in the upcoming quarter?” comments from dealers focused on the following market observations:

- Camping Season: Dealers anticipated improving sales as the weather gets warmer. For those who follow our PowerTrackerTM reports, the expected bump in Q2 from camping season will come as no surprise.

- Severe Weather Season:Similarly, dealers expect sales to improve as higher temperatures mean more moisture in the air and summer storms. After recent high-profile wildfires, California Pacific Gas and Electric is expanding its severe weather shut-off program, so that in anticipation of severe weather and wildfire conditions, all 5.4 million of its customers may have their power shut off, as opposed to its previous program that only impacted 570,000. Whether power outages are intentional or due to natural disasters, severe weather season is expected to lead to increased sales.

- Recalls: Several dealers reported a drop in sales in Q1 due to product recalls, but expect sales to return to normal next quarter, now that those issues have been addressed.

When asked, “What changes have you recently noticed among particular customer groups or product categories within your market?” there were several comments that emerged as common themes. Many of these are comments that have carried from quarter to quarter but the following is a sampling of some key observations:

- Data centers and oil fields continue to drive commercial demand for gen-sets, while the trend of residential consumers toward whole-house backup power instead of single-circuit, which we’ve previously reported, is also continuing. This plays into a larger trend we heard about that end-users are demanding higher-wattage gen-sets than they did previously.

- Despite dealer reports of increased spending and a strong economy, we also heard several comments about increasing price consciousness and competition from off-brands.

Tyler Wiegert is a Project Manager at Power Systems Research (PSR), a market research and consulting company headquartered in St. Paul, MN