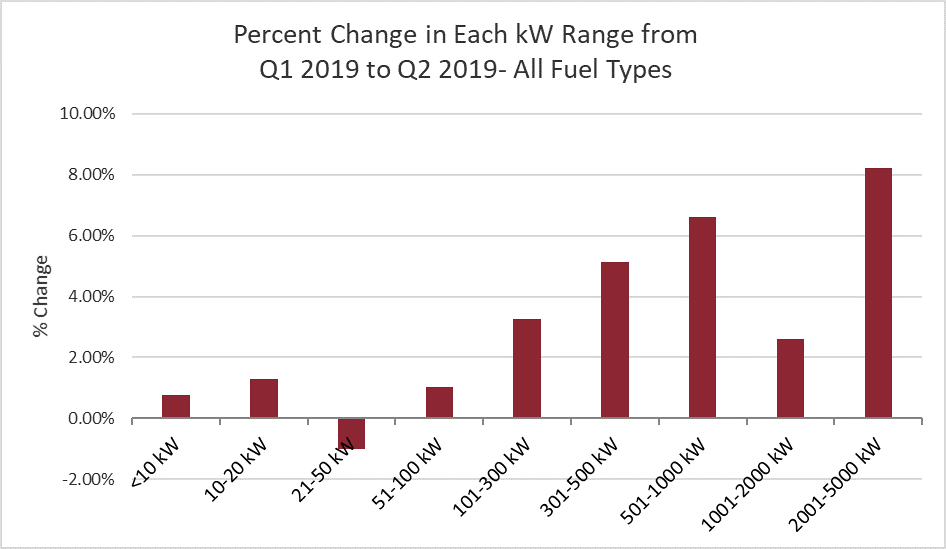

SUMMARY: Gen-set sales in Q2 2019 rose 4.3% from Q1 2019, due to increases in commercial demand and demand for standbys that are typical for Q2 as construction season and hurricane season begin. Broken out by kW range, sales increases were on the lower end of normal in the 51-100kW and 101-300kW ranges, but overall sales were still driven by typical growth in the 101kW-1MW ranges, typical of the construction season.

Following a first quarter that avoided the typical decline in <10kW, 10-20kW, and 21-50kW, diesel sales in Q2 did fall in those ranges by 12%, 6%, and 5%, respectively.

Natural gas sales were about flat, reaching low-single-digit growth in the portable ranges and mid-single-digit growth in the 101kW-1MW ranges, reflecting demand from campers and construction.

On a Year-on-Year basis, overall unit sales for Q1 2019 were up 1.9% compared to sales levels in Q2 2018.

The data comes from the proprietary PowerTrackerTM series of syndicated surveys conducted each quarter by Power Systems Research. A total of 1,400 interviews are completed each quarter with gen-set dealers and distributors, businesses and households across North America.

Despite most power ranges in both diesel and natural gas performing on the lower end of normal, sales in the 101-300kW, 301-500kW, and 501kW-1MW ranges performed sufficiently strongly to return a decent overall growth. Diesel overperformed its history in those ranges, reaching 7% in the lower two ranges, and 10% in the higher range.

Natural gas sales were lower than usual, but these ranges still returned the best performance, reaching 2% in the lowest range, and 4% in the two higher ranges. While diesel sales declined in the <10kW, 10-20kW, and 21-50kW ranges, natural gas reached 1% and 2.5% growth, which is historically soft.

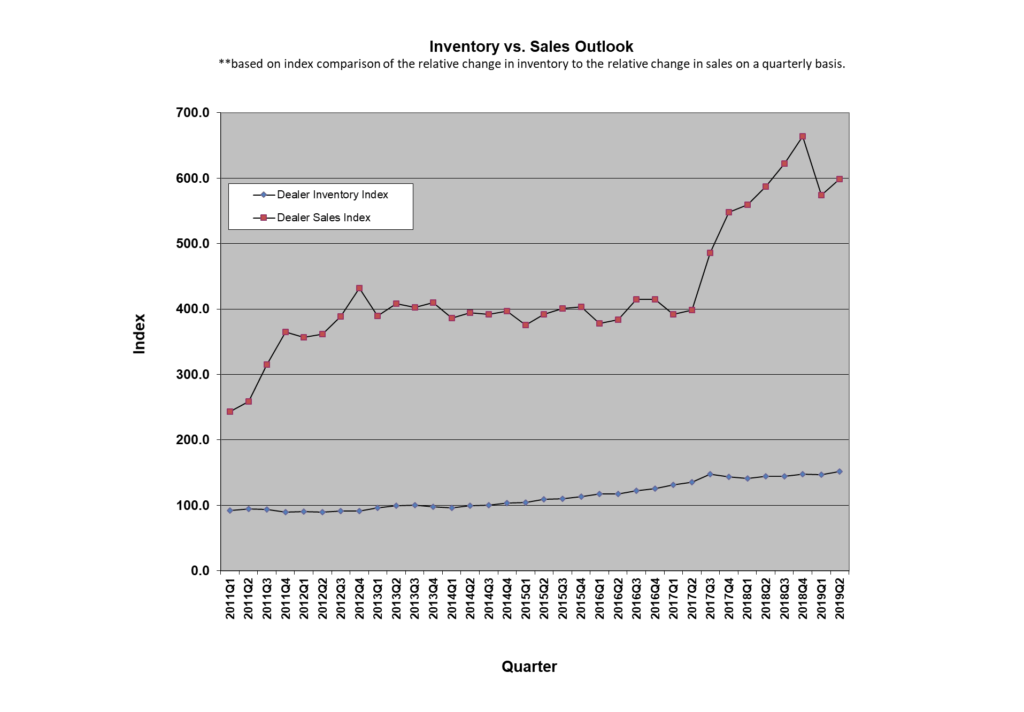

Dealer inventory levels rose 3.5% in Q2 2019 compared to the previous quarter, which is typical QoQ inventory growth for Q2 over the past several years. This leaves inventories 5.5% higher than Q2 2018.

As part of our PowerTrackerTM series, we also monitor gen-set sales trends by application. Standby gen-set sales were dominant, growing about 8%.

This is similar to Q2 2018 but is significantly higher than the 1-5% growth for standbys in Q2 in previous years. We saw a downward correction in standby sales in Q1 2019, the first quarter without historically outstanding growth since the hurricane season of Q3-Q4 2017, possibly indicating that the market for newly activated consumers scrambling to buy emergency backup power might be reaching saturation.

But Q2’s strong standby growth may be showing that there is still a reserve of new consumers that can be activated on a seasonal basis when hurricane warnings are salient. This increase in demand for standby power dovetails with several comments we’ve heard from dealers about the increased demand for whole-home standby in new construction.

Dealer/Distributor Outlook for Q3 2019

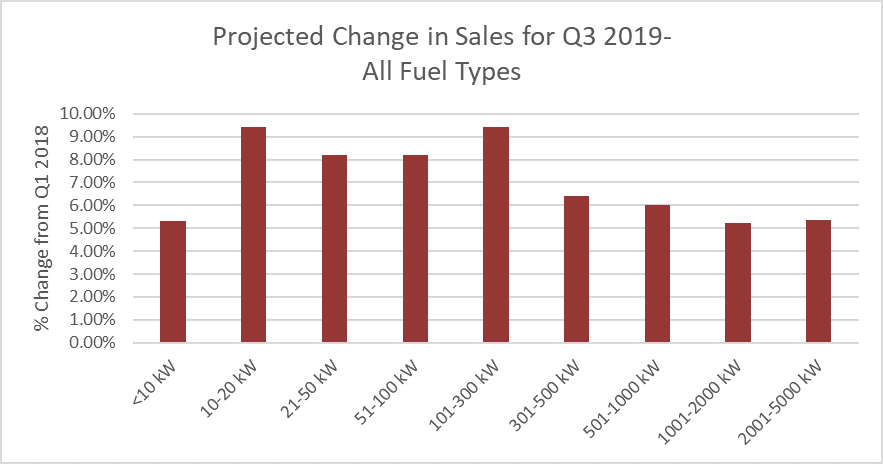

Dealers and distributors expect sales in Q3 2019 to increase 5-10% in all power ranges, an unusually positive outlook for Q3 that may reflect the low starting position after a rocky Q1 and soft-to-normal Q2 as much as real optimism about Q3.

Following an unusually soft Q2 for <10kW and 10-20kW gen-sets, dealers and distributors expect 5% growth in <10kW sales (typical for Q3 expectations) and 9.5% growth in 10-20kW sales (slightly stronger than normal). They project this growth to be driven by gaseous gen-sets, which they believe will reach 5% and 10% growth in those ranges, while forecasting about 2% growth for diesel in those ranges.

The ongoing constructions season is expected to bring 5%-10% growth in the >20kW ranges, with similar performance expected for diesel and natural gas.

When asked, “Why do you expect sales to change in the upcoming quarter?” comments from dealers focused on the following market observations:

- Camping Season: Dealers anticipated improving sales as the weather continues to get warmer, and then a slight uptick again as the weather starts to cool down for the fall and a second wave of fair-weather campers heads outdoors.

- Severe Weather Season:As we head into another hurricane season, dealers are expecting an increase in sales. Exceptionally strong standby sales this quarter give proof to dealer assumptions that increasingly severe weather will drive sales going forward.

- Construction Season: The construction season brings government contracts as well as residential construction. Dealers continue to report a trend toward whole-home standby power. They also report much greater quote activity which they attribute to confidence in the long-running economic expansion.

When asked, “What changes have you recently noticed among particular customer groups or product categories within your market?” there were several comments that emerged as common themes. Many of these are comments that have carried from quarter to quarter but the following is a sampling of some key observations:

- Aside from the increased desire to be prepared for natural disasters, planned and unplanned power outages, and the consequent rise in whole-house generators, dealers report that the rise in residential demand is being accompanied by a shift in consumer demographics toward younger buyers.

- Consumers are increasingly drawn to technological advancements in their power generation. The move toward natural gas has been going on for years, but consumers are now also demanding silent generators, generators that can be monitored remotely by phone, and inverters. PSR

METHODOLOGY: Since 1998, Power Systems Research (PSR) has been continuously maintaining its PowerTrackerTM series of syndicated surveys, conducting 1,400 interviews each quarter among three key respondent groups in North America: gen-set dealers and distributors, businesses and households.

We conduct 200 interviews each quarter among dealers and distributors; the focus of this survey is on recent sales and market observations for the current quarter as well as expectations for the coming quarter.

Our Business Consumer survey consists of 900 interviews per quarter among a wide cross section of businesses to gather their input concerning ownership, usage trends and motivating factors for purchase, including any concerns about the reliability and availability of electric power.

Finally, our Household Consumer survey consists of 300 interviews per quarter to learn more about gen-set ownership trends among households and monitor the likelihood of a gen-set purchase. PSR

Tyler Wiegert is a Project Manager at Power Systems Research (PSR), a market research and consulting company headquartered in St. Paul, MN.