SUMMARY: Gen-set sales in North America continued to grow in Q4 2018, with dealers reporting an overall unit sales increase of 6.7% over Q3 2018, largely due to a continued strong demand level for standby units by private consumers.

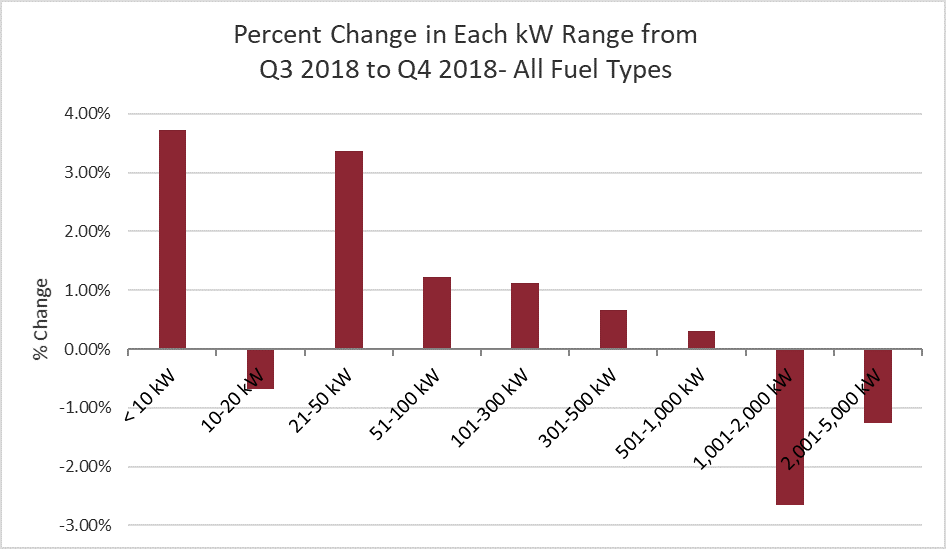

Fourth quarter performance was also bolstered by an historically unusual surge in demand for temporary gen-sets. The strongest growth this quarter came from the <10kW and 21-50kW ranges, driven by 3-6% growth for both diesel and gaseous gen-sets in those ranges.

On a Year-on-Year basis, overall unit sales for Q4 2018 were up 21.1% compared to sales levels in Q4 2017.

Five quarters after the hurricane season at the end of 2017, the gen-set market has not yet corrected. Both Q3 2018 and Q4 2018 saw 20+% YoY growth over 2017, despite the dramatic increase in unit sales in Q3 2017 and Q4 2017 to meet the demand caused by hurricanes in the southeast.

We see this as further evidence that those hurricanes brought new consumers into the market, beyond those directly affected by the hurricanes in 2017.

This data comes from the proprietary PowerTrackerTM series of syndicated surveys conducted each quarter by Power Systems Research. A total of 1,400 interviews are completed each quarter with gen-set dealers and distributors, businesses and households across North America.

Growth in Q4 2018 was due in large part to the low-to-mid single-digit growth in diesel sales in all power ranges except 10-20kW. While gaseous gen-sets performed similarly in the ranges below 100kW, they declined by 1-2% QoQ in the 101-500kW range, and by about 10% QoQ above 1MW, a normal showing for the fourth quarter.

In the last five years, of the nine power ranges we consistently receive data for on the dealer survey (5MW+ is intermittently available), Q4 has only shown positive performance for diesel in 5 power range-year combinations.

This year, eight of those nine power ranges for diesel were in positive territory. While only the <10kW, 21-50kW, and 101-300kW ranges surpassed 2% growth QoQ it was enough to keep overall growth positive for diesel in the 51kW-1MW ranges.

Dealer inventory levels expanded 2.3% QoQ during Q4 2018. This leaves inventories 2.7% higher than Q4 2017, which is historically modest growth, showing OEMs have struggled to meet the increased demand.

Numerous dealers noted that OEMs are not currently able to meet their orders quickly enough, particularly with the complete phase-in of Tier 4 Final during 2018.

As part of our PowerTrackerTM series, we also monitor trends in gen-set unit sales by application type. Standby sales increased 7.2% in Q4 2018, QoQ which is slightly above average for changes in the fourth quarter.

Dealers attribute this to normal winter purchasing behavior, they but note that the seasonal effect has been increased by a larger, younger customer base, as well as economic confidence.

Portable sales increased another 3%, QoQ marking the second consecutive fourth quarter, and only the second fourth quarter since 2013, with positive growth for portables.

Temporary units were the standout, however, with a sales increase of 7.6%. Temporary units nudged out standby applications for the best performing application in Q4 2018.

METHODOLOGY: Since 1998, Power Systems Research (PSR) has been continuously maintaining its PowerTrackerTM series of syndicated surveys, conducting 1,400 interviews each quarter among three key respondent groups in North America: gen-set dealers and distributors, businesses and households.

We complete 200 interviews each quarter among dealers and distributors; the focus of this survey is on recent sales and market observations for the current quarter as well as expectations for the coming quarter.

Our Business Consumer survey consists of 900 completed interviews per quarter among a wide cross section of businesses to gather their input concerning ownership, usage trends and motivating factors for purchase, including any concerns about the reliability and availability of electric power.

Finally, our Household Consumer survey consists of 300 completed interviews per quarter to learn more about gen-set ownership trends among households and monitor the likelihood of a gen-set purchase.

Dealer/Distributor Outlook for Q1 2019

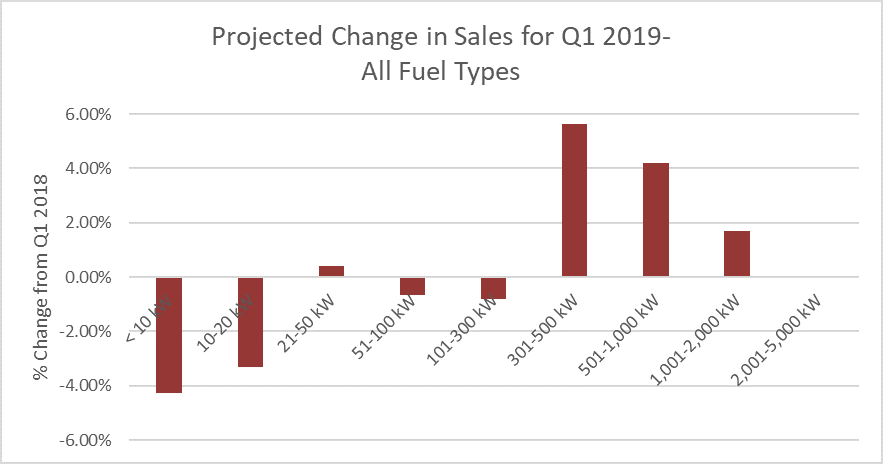

Dealers and distributors expect unit sales in Q1 2019 to decline modestly, following the pattern set in previous years. They anticipate low single-digit declines in the below-300kW ranges, partially offset by low-to-mid single-digit gains in the 300kW-2MW ranges.

The largest gains expected are a 4.5-6.5% increase in diesel sales in the ranges of 51-100kW, 101-300kW, and 301-500kW, followed by a roughly 5% bump in gaseous gen-sets between 500kW and 2MW. During Q1 2019 we expect to see moderate growth in all power ranges for diesel, while gaseous gen-sets receive their typical first quarter prediction of moderate declines in all power ranges.

When asked, “Why do you expect sales to change in the upcoming quarter?” comments from dealers focused on the following market observations:

- Tier 4 Final has Completely Phased in: Dealers did not all express the same predictions for how this was going to affect Q1 sales in 2019. Some anticipated that sales would decline, because Tier 4 Final units are more expensive.

Others reported increased quote activity from construction companies who were looking to replace their units in order to be compliant on their job sites. There were also reports of greater consumer knowledge, with some dealers saying consumers had been waiting to purchase until Tier 4 Final units were in stock.

- Supply Chain Issues: Regarding Tier 4 Final units being in stock, numerous dealers mentioned that their OEMs were far behind on fulfilling orders, and that inventories have not been growing fast enough to meet increased demand.

Dealers seem to have the widespread impression that OEMs were not ready for Tier 4 Final and did not have a supply of units or parts set aside. Some noted, however, that OEMs may be struggling to decide how to handle ongoing tariff concerns, whether to produce and import, or just wait to see if the situation resolves itself.

Additionally, the Outdoor Power Equipment Institute (OPEI), recently sent a letter to the Trump administration explaining that OEMs were unable to ship and sell engines as long as the government was shut down, because the EPA was unavailable to certify their products.

When asked, “What changes have you recently noticed among particular customer groups or product categories within your market?” there were several comments that emerged as common themes. Many of these are comments that have carried from quarter to quarter, but here is a sampling of some key observations:

- Ongoing trends show a greater demand for standby and natural gas gen-sets. We have also been hearing about booming demand from data centers and hospitals for standby generators the last few quarters.

- Several dealers reported their customer base has gotten younger by about 30 years, with many 25-35-year-olds coming in to buy equipment they’ve already researched online. Others use a visit to their dealership as an opportunity to do research and check prices against what they’ve seen online.

- Dealers have talked to us in the past about how the off-brand generators sold at big box stores have eaten into their sales in an increasingly price-conscious world. That trend seems to be continuing as a number of dealers for one particular OEM told us the OEM had started selling its generators in big box stores, and it was resulting in large losses at their dealership. PSR

Tyler Wiegert is a Project Manager at Power Systems Research (PSR), a market research and consulting company headquartered in St. Paul, MN