SUMMARY: Gen-set sales experienced a sharp increase in Q3 2017 with overall sales up 21.8% over Q2 2017 levels due to demand from hurricanes Harvey and Irma. This increase follows Q2 2017 where dealer reported sales were up 1.8% relative to Q1 2017 levels.

The strong increases were most obvious in the smaller gasoline ranges with <10 kW up 23.6%, 10-20 kW up 11.1% and 21-50 kW up 12.2% relative to Q2 2017 levels. Sales of diesel gen-sets also experienced sizable increases in the lower kW ranges with <10 kW up 15% and 10-20 kW sets up 12.9% for the third quarter.

On a Year-on-Year basis, unit sales for Q3 2017 were up 11.3% when compared to sales levels in Q3 2016.

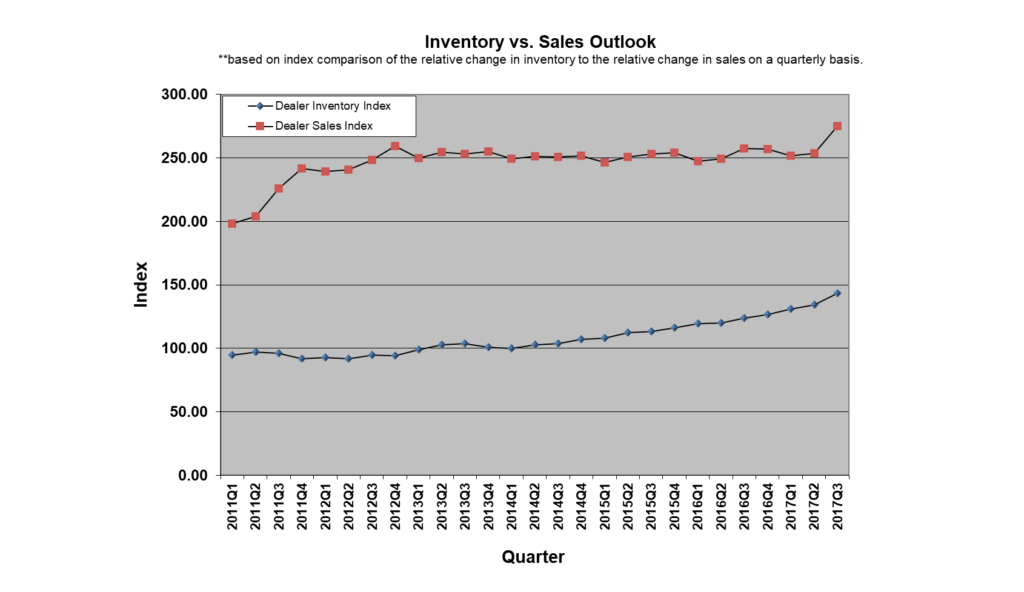

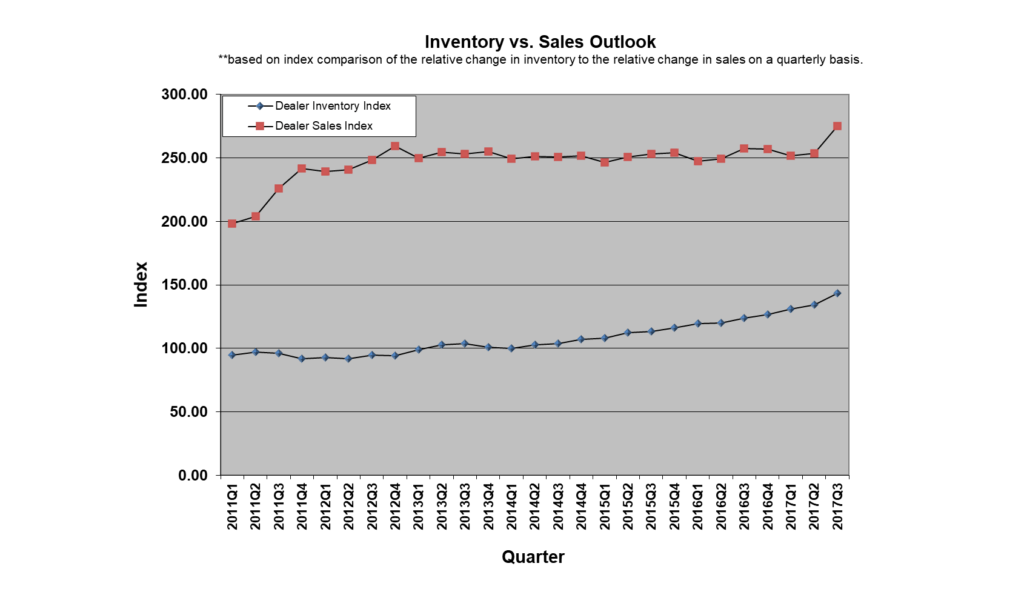

Although dealers experienced strong sales in Q3 2017 they also replenished inventories at a higher rate than normal. Gen-Set dealers and distributors reported inventory levels in Q3 2017 were up 9% from Q2 2017 levels. Considering Year-on-Year changes, inventory levels at the end of Q3 2017 were 15.2% higher than the end of Q3 2016.

Dealers and distributors anticipate the fourth quarter will have some expected decreases in activity in the lower kW ranges as the hurricane season has passed. The fourth quarter will see 5% to 10% decreases in the power ranges <20 kW. The strongest area for growth expected for Q4 2017 is with diesel gen-sets from 50 kW to 1000 kW generally increasing in the range of 3% to 4%. Lower growth rates were anticipated during Q4 2017 for gaseous fueled gen-sets >50 kW. The one growth range for gaseous fueled gen-sets was in residential standby and smaller commercial standby sets in the range from 21-50 kW.

METHODOLOGY: Since 1998, Power Systems Research (PSR) has been continuously maintaining its PowerTrackerTM series of syndicated surveys, conducting 1,400 interviews each quarter among three key respondent groups in North America: gen-set dealers and distributors, businesses and households.

We conduct 200 interviews each quarter among dealers and distributors; the focus of this survey is on recent sales and market observations for the current quarter as well as expectations for the coming quarter.

Our Business Consumer survey consists of 900 interviews per quarter among a wide cross section of businesses to gather their input concerning ownership, usage trends and motivating factors for purchase, including any concerns about the reliability and availability of electric power.

Finally, our Household Consumer survey consists of 300 interviews per quarter to learn more about gen-set ownership trends among households and monitor the likelihood of a gen-set purchase.

Our latest results from the PowerTrackerTM dealer and distributor survey showed that overall sales experienced a sharp increase in Q3 2017 with overall sales up 21.8% over Q2 2017 levels due to demand from hurricanes Harvey and Irma. This increase follows Q2 2017 where dealer reported sales were up 1.8% relative to Q1 2017 levels.

The strong increases were most obvious in the smaller gasoline ranges with <10 kW up 23.6%, 10-20 kW up 11.1% and 21-50 kW up 12.2% relative to Q2 2017 levels. Sales of diesel gen-sets also experienced sizable increases in the lower kW ranges with <10 kW up 15% and 10-20 kW sets up 12.9% for the third quarter.

On a Year-on-Year basis, unit sales for Q3 2017 were up 11.3% when compared to sales levels in Q3 2016.

Although dealers experienced strong sales in Q3 2017 they also replenished inventories at a higher rate than normal. Gen-Set dealers and distributors reported inventory levels in Q3 2017 were up 9% from Q2 2017 levels. Considering Year-on-Year changes, inventory levels at the end of Q3 2017 were 15.2% higher than the end of Q3 2016.

Dealer/Distributor Outlook for Fourth Quarter 2017

When asked about the short-term outlook, PowerTrackerTM dealer and distributor respondents anticipate the fourth quarter will have some expected decreases in activity in the lower kW ranges as the hurricane season has passed. The fourth quarter will see 5% to 10% decreases in the power ranges <20 kW. The strongest area for growth expected for Q4 2017 is with diesel gen-sets from 50 kW to 1000 kW generally increasing in the range of 3% to 4%. Lower growth rates were anticipated during Q4 2017 for gaseous fueled gen-sets >50 kW. The one growth range for gaseous fueled gen-sets was in residential standby and smaller commercial standby sets in the range from 21-50 kW.

When asked, “Why do you expect sales to change in the upcoming quarter?” comments from dealers focused on the following market observations:

- Weather/Hurricane: The weather issuebrought a variety of answers this quarter and “weather” was involved in more open-ended survey responses than any other quarter during the 15-year history of our survey. Many dealers that experienced increased sales from hurricanes Harvey and Irma anticipate sales to decrease relative to levels seen during the third quarter. This would be expected. However, dealers in the northern climates are gearing up for winter weather and know that the impacts of ice storms and volatile winter weather are bound to have some positive impact on sales during the winter months.

- Seasonal: A number of dealers on the consumer side pointed to sales during third quarter and into the fourth quarter due to outdoor activities – everything from tailgating for football games to power for hunting trips.

- Quotations: Dealers focusing on commercial/industrial sets pointed to end of year budgets that need to be spent and a sense of optimism that orders will be finalized before the end of the year. This is reflected in the higher expected sales of 3% to 4% quarterly increases expected for diesel gen-sets during Q4 2017.

When asked, “What changes have you recently noticed among particular customer groups or product categories within your market?” there were several comments that emerged as common themes. Many of these are comments that have carried from quarter to quarter but the following is a sampling of some key observations:

- Greater customer awareness across the board for the need for backup power in homes and businesses.

- The age range has widened for those interested in home standby. This has generally been an older demographic but there were a few comments this quarter that indicated a wider age range of interested customers including a definite younger end of the demographic too.

- A growth in the number of inquiries for of data center and information security applications.

- More interest in gen-sets mandated for life-safety systems.

- More interest in natural gas gen-sets.

While overall inventory levels continue a smooth and steady rise, the sales index rose sharply during Q3 2017. As we move past the effects of the hurricane season we would expect the inventory levels to potentially pull back or at least level off at some point during 2018. We would expect this inventory leveling to be gradual, though, as the impact of weather related sales is still fresh in the minds of dealers across the country after the most recent hurricane season. PSR

Joe Zirnhelt is President and CEO at Power Systems Research (PSR), a market research and consulting company headquartered in St. Paul, MN. E-mail: info@powersys.com;