SUMMARY: North American Gen-set sales continued with strong growth in the lower kW ranges in Q4 2017 with overall unit sales up 12.9% over Q3 2017. The gains were driven by ongoing demand caused by severe hurricanes, as well as optimism about the economy.

This increase follows Q3 2017 where dealers reported sales increased a remarkable 21.8%. Sales dropped off in the larger kW ranges after a banner Q3, however.

On a Year-on-Year basis, unit sales for Q4 2017 were up 19.5% compared to sales levels in Q4 2016.

The data comes from the proprietary PowerTrackerTM series of quarterly syndicated surveys conducted by Power Systems Research. A total of 1,400 interviews are completed each quarter with gen-set dealers and distributors, businesses and households in North America.

Solid growth continued in the smaller gaseous (gasoline, natural gas, propane) kW ranges with <10 kW up 12.2%, 10-20 kW up 8.6% and 21-50 kW up 5.4% relative to Q3 2017 levels.

Sales of diesel gen-sets held steady in the lower kW ranges with <10 kW remaining flat and 10-20 kW sets up only 2% for the fourth quarter.

After the hurricane-driven climb in Q3 2017 sales, however, sales dropped 3%-5% in each of the 301-500 kW, 501-1000 kW, and 1001-2000 kW ranges, and 5%-7.5% in the 2001-5000 kW range, for each diesel and gaseous fuels.

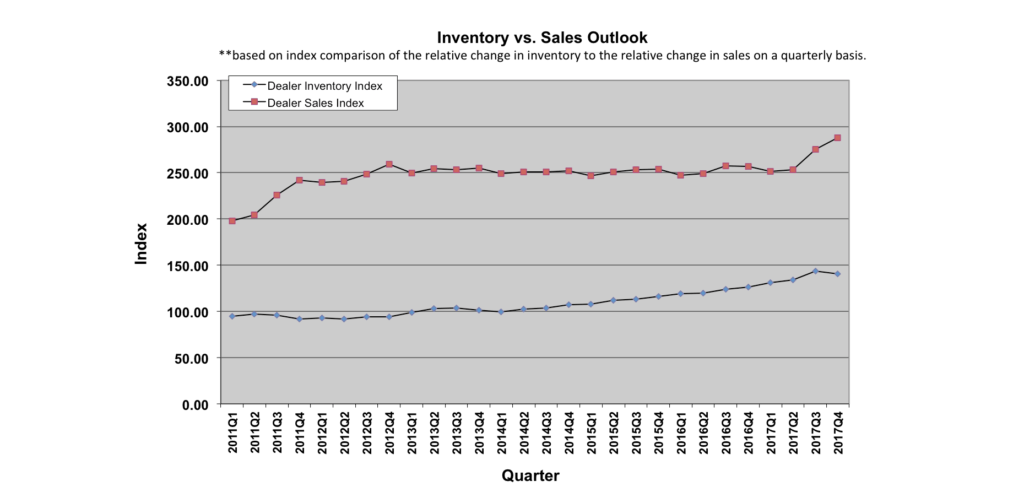

Last quarter, we reported that dealers had replenished inventories at a higher rate than normal, despite strong sales.

This quarter, we heard from some of our PowerTrackerTM respondents that it was not fast enough. Between wildfires in California and hurricanes battering the East Coast, we heard from many dealers that their inventories had been wiped out, and overall inventories declined by 2.8% relative to Q3 2017.

On a YoY basis, inventory levels at the end of Q4 2017 were still 10.6% higher than the end of Q4 2016

Dealers were still seeing an increase in demand in Q4, so much so that it started eating into their inventories and some were not able to replenish quickly enough to meet the demand in their area. But it wasn’t enough to overcome the growth in inventories over the previous three quarters.

METHODOLOGY: Since 1998, Power Systems Research (PSR) has been continuously maintaining its PowerTrackerTM series of syndicated surveys, conducting interviews each quarter among three key respondent groups in North America.

We conduct 200 interviews each quarter among dealers and distributors; the focus of this survey is on recent sales and market observations for the current quarter as well as expectations for the coming quarter.

Our Business Consumer survey consists of 900 interviews per quarter among a wide cross section of businesses to gather their input concerning ownership, usage trends and motivating factors for purchase, including any concerns about the reliability and availability of electric power.

Finally, our Household Consumer survey consists of 300 interviews per quarter to learn more about gen-set ownership trends among households and monitor the likelihood of a gen-set purchase.

Dealer/Distributor Outlook for Q1 2018

When asked about the short-term outlook, PowerTrackerTM dealers and distributors anticipate the first quarter of 2018 will have some expected decreases in activity in the lower kW ranges as the hurricane season has passed, but changes will be segmented by fuel type.

For diesel gen-sets, Q1 2018 will be about flat in the power ranges <20 kW, but will decline between 4% and 8% in the 20-100 kW, 301-500 kW, and 1001-5000 kW ranges.

Gaseous-powered gen-sets will decline 7%-12% in the <300 kW range, but may actually see modest growth in the 301-5000 kW range. The strongest area for growth expected for Q1 2018 is with gaseous gen-sets from 1001 kW to 2000 kW increasing about 5%.

When asked, “Why do you expect sales to change in the upcoming quarter?” comments from dealers focused on the following market observations:

- Improving Weather: As expected, growth slowed somewhat after the hurricane season passed. We heard from many dealers, though, that the recent spate of hurricanes has made consumers more conscious of the need for backup power.

In fact, in our Business Consumer survey we saw an increase in the number of respondents who cited extended power outages and frequent power outages as a reason to buy a gen-set, and a decrease in the number of power outages that would cause them to purchase a generator.

Further slow-down in growth may also be tempered by ongoing wildfires in California, which have had a similar, albeit more muted effect as recent hurricanes.

- Political-Economic: Dealers are divided on how to feel about the current political-economic environment. On one hand, the economy is strong, and consumer confidence is growing. More than a few dealers attributed this to the recent tax cuts and the leadership of the Trump White House in rolling back regulations.

Others were not as optimistic. They focused on political fighting and the shrinking government as the reason that their government-side orders have stalled or evaporated. Whatever the case may be, we will likely hear both sides of this story for the foreseeable future.

- Seasonal: Expectations are largely negative for Q1 2018, with overall expectations ranging anywhere from roughly flat to -10% growth, depending on the kW range. Dealers cited historically poor Q1 performance, as well as a hiatus on outdoor activities as the primary reasons. The smallest declines are in the <20 kW diesel range, at less than a 1% decline, matching what we heard from some dealers than Q1 is the best time for the sale of portables.

When asked, “What changes have you recently noticed among particular customer groups or product categories within your market?” there were several comments that emerged as common themes. Many of these are comments that have carried from quarter to quarter, but the following is a sampling of some key observations:

- Greater customer awareness across the board for the need for backup power in homes and businesses. Dealers are specifically citing hurricanes as driving this awareness.

- More interest in natural gas gen-sets.

- A strong economy is driving consumer confidence

- Price consciousness is pushing consumers to get multiple quotes, but ultimately buy online from foreign manufacturers

The sales index continued a second quarter of growth not seen for over 5 years, resulting in the first decline in the inventory index since 2014. Going forward, we will be watching to see if the recent lessons from the hurricane season stick in the minds of consumers and if the increased demand for emergency back-up power holds.

Relatedly, we will be interested to see if dealers can capitalize on the present surge in demand, or if they will be unable to restock in time before the weather improves and the economy returns to a more normal growth rate. PSR

Tyler Wiegert is a Research Analyst and Project Manager with Power Systems Research (PSR), a market research and consulting company headquartered in St. Paul, MN. E-mail: info@powersys.com;