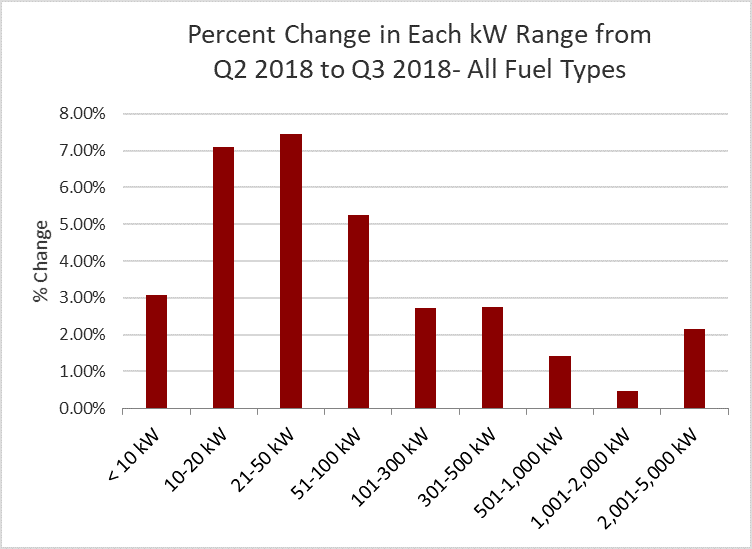

SUMMARY: Gen-set sales in North America climbed 6% in Q3 2018 over Q2 2018, with the focus switching from larger industrial standby’s and construction site power generation earlier in the year to residential standby sales as part of winter-preparedness.

The strongest growth this quarter came from the 10-20kW and 20-50kW ranges, driven primarily by high single-digit growth in gaseous generators. Diesel was also a factor in these ranges, contributing low-to-mid single-digit growth. On a Year-on-Year basis, overall unit sales for Q3 2018 were up 28.2%, compared to sales levels in Q3 2017.

For those who regularly read our quarterly update, that will sound higher than we normally report. This quarter, we altered the way we calculate our inventory and sales indices, so that we can more accurately calculate YoY changes while maintaining a historical perspective. The need for this became clear after the explosive growth during the hurricane season at the end of last year.

The data comes from the proprietary PowerTrackerTM series of syndicated surveys conducted by Power Systems Research. A total of 1,400 interviews are completed each quarter with gen-set dealers and distributors, businesses and households across North America.

Last quarter, we reported strong sales in each power range, especially when considered in the context of previous Q2 rebounds. That strong growth in Q2 seems to have cannibalized Q3 sales to some extent. While a 7% growth rate in the 10-20kW and 20-50kW ranges is impressive, it does not quite measure up to the 12% and 9.5% growth in Q3 2017, or the 11% growth in each range in 2016.

Those years had comparatively worse Q2 sales. So, in light of Q3 2018’s relative slowdown, Q2’s growth could be reevaluated as consumers preparing unusually early for storm season, rather than yet another jump in the baseline size of the market.

That being said, dealers reported a 5% jump in sales of 51-100kW generators, and 2% growth in 101-300kW and 301-500kW generators, which is historically average, even with the better-than-average Q2 growth in those ranges. This was driven almost entirely by mid-single-digit growth in gaseous gen-sets, as diesel was held under 1% growth in those ranges.

Dealer inventories were level over the last quarter[JZ1] . This leaves inventories 2.5% lower than Q3 2017, an expected decline following the run on generators late last year.

As part of our PowerTrackerTM series, we also monitor gen-set sales trends by application type. Standby sales grew another 10.7% in Q3 2018, marking the fourth Q3 in a row to post double-digit growth in standby sales. Dealers attribute this to the normal seasonal shift into winter.

This quarter, we also launched a PowerTrackerTM report focused solely on portables. While sales levels of portables have grown significantly over the past year, they have only now returned to Q1 2013 levels. This may be a sign that last year’s 20% spike in <10kW sales was due to new and inexperienced consumers who will be seeking to trade those out for larger standby generators if severe weather continues. We will be watching to see if this is the case.

METHODOLOGY: Since 1998, Power Systems Research (PSR) has been continuously maintaining its PowerTrackerTM series of syndicated surveys, conducting 1,400 interviews each quarter among three key respondent groups in North America: gen-set dealers and distributors, businesses and households.

We conduct 200 interviews each quarter among dealers and distributors; the focus of this survey is on recent sales and market observations for the current quarter as well as expectations for the coming quarter.

Our Business Consumer survey consists of 900 interviews per quarter among a wide cross section of businesses to gather their input concerning ownership, usage trends and motivating factors for purchase, including any concerns about the reliability and availability of electric power.

Finally, our Household Consumer survey consists of 300 interviews per quarter to learn more about gen-set ownership trends among households and monitor the likelihood of a gen-set purchase.

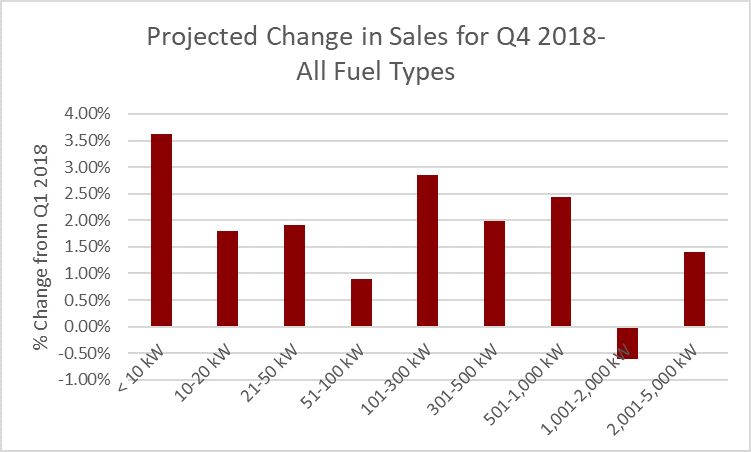

Dealer/Distributor Outlook for Q4 2018

Dealers and distributors expect Q4 2018 to slow down, following the pattern set in previous years. They anticipate low single-digit growth in all ranges, except for a negligible decline in the 1-2MW range. The largest gains are an expected 6% increase for standby diesel generators in the 10-20kW range, followed by a predicted 4% bump in 101-300kW diesel generators.

Gaseous generators are expected to slow down in all ranges, with the highest growth being a 4% increase in <10kW sets. Typically, dealers expect 5-10% growth in gaseous-powered, residential-grade, standby generators in Q4, but their expectations for 2018 are for <2% growth.

This lower than normal outlook may signal further evidence of our instinct that consumers have prepared early this year, or possibly as a sign that dealers believe the market for new storm-conscious consumers is becoming saturated.

When asked, “Why do you expect sales to change in the upcoming quarter?” comments from dealers focused on the following market observations:

- Upcoming Severe Winter Weather: Power Systems Research is based in St. Paul, Minnesota, so we are no stranger to the need to be prepared for harsh winters. Several dealers cited the upcoming winter weather as a reason for increased quote activity. Not all of this activity is out of concern. Some of those forecasted portable sales will be powering heaters in ice fishing houses across northern lakes.

- Decline in Construction Business: We see more signs thatwinter sales are region-dependent. While icy regions may get a bump in winter-preparedness sales, rainier regions need to contend with a decline in outdoor activities as well as a decline in construction activity. Thirty-five degrees may not be cold for ice fishing or concerns about ice storms causing power outages, but it is cold enough to keep many crews off job sites.

When asked, “What changes have you recently noticed among particular customer groups or product categories within your market?” there were several comments that emerged as common themes. Many of these are comments that have carried from quarter to quarter but the following is a sampling of some key observations:

- There is a continued push for gaseous gen-sets. Dealers attribute this to emissions regulations and the presence of cheaper fuel options than diesel.

- Dealers continue to report that consumers are increasingly price-conscious, often researching online before ultimately buying at a big-box store or from overseas. Ironically, dealers also report that consumers are increasingly optimistic about the strong economy, and that the consumers visiting their stores are willing to spend more than in the past. They are particularly interested in new features like electric start.

As mentioned at the top of this article, we have changed how we calculate our Inventory and Sales Indices. They are no longer true indices, in the sense that a 1% increase in sales results in a 1-point increase in the index. Last year’s explosive growth made apparent to us that that method could not accurately calculate YoY growth or adequately display the magnitude of historical trends when years of extraordinary growth like 2011 or 2017 pull the index far from the base year’s inventory and sales levels.

Now, a 1% change in Sales does not equal a 1-point change in the sales index, as it has previously; instead, a 1% change in Sales equals a 1% change in the sales index.

For example, if the index was at a value of 150, and sales went up by 1%, the old system would have the index go to 151. Under the new system, the index goes up to 151.5. Not a big deal when you’re that close to 100, but the index had been up to around 300, so it was starting to amount to a pretty substantial difference when you had consecutive quarters of double-digit growth.

This will allow us to accurately calculate YoY growth and visually display just how dramatic last year’s growth was. We look forward to bringing this improved approach to you in future quarters. PSR

Tyler Wiegert is a Project Manager at Power Systems Research (PSR), a market research and consulting company headquartered in St. Paul, MN