FAR EAST: SOUTH KOREA REPORT

Korean materials giants are rushing to increase production of battery materials for EVs. Lotte Chemical plans to invest 160 billion yen to build plants for electrolytes and other materials in Korea and the U.S. LG Chem and POSCO have also announced plans to increase production. The three major Korean battery manufacturers, including LG, have active investment plans, but they are lagging their Chinese counterparts in the upstream area of battery materials. Materials companies are also increasing their supply capacity to compete with the Chinese.

Lotte Chemical, a major petrochemical company, will build a new plant for organic solvents for electrolytes in its own plant. The company will build a new factory with a total investment of 602 billion won, aiming for production by the end of 2023. The company is also considering building a plant related to electrolyte and cathode materials in Louisiana, U.S. It has begun coordination with local governments and other related parties in anticipation of starting production in 2025. The investment is expected to be in the order of 100 billion yen.

LG Chem is also planning to invest 6 trillion won over the next five years in battery materials to mass produce NCMA cathode materials by 2025. POSCO and LG have also begun to secure upstream resources. POSCO has acquired mining interests in a lithium Salt Lake in Argentina, while LG has signed a long-term purchasing contract with an Australian resource company.

Batteries account for 30% of the cost of EVs. Furthermore, looking at the cost structure of automotive batteries, the cathode materials used by POSCO and LG Chemical account for 58% of the cost, making them an important component.

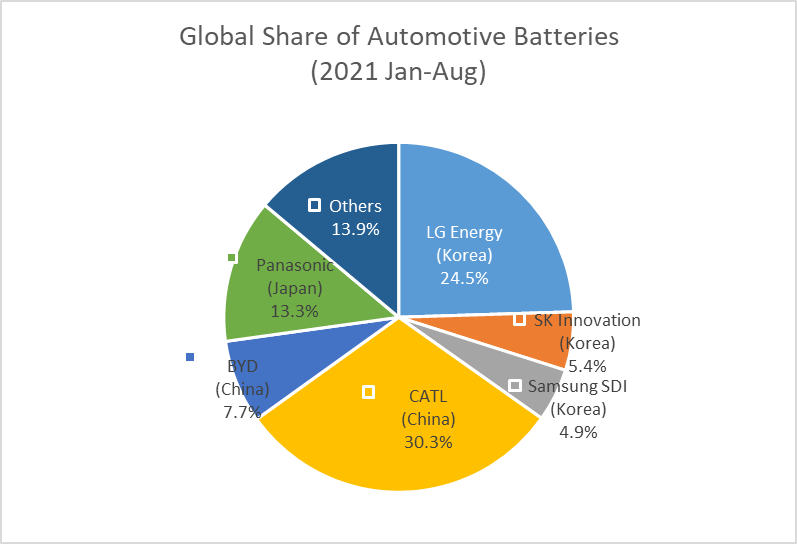

Chinese battery material manufacturers are growing rapidly, led by CATL and BYD, and are also expanding business with Korean and Japanese battery manufacturers. The supply chain for EVs, from battery materials to batteries to finished vehicles, is being concentrated in China. In contrast, although the three major Korean battery makers account for about one-third of the market share for automotive batteries, they are currently lagging in battery materials.

Source: The Nikkei

PSR Analysis: The demand for a stable supply of batteries from complete vehicle manufacturers is growing stronger by the day. This is due to the uneven distribution of mineral resources used to make batteries and the growing risks in the international situation, such as friction between the U.S. and China and war between Russia and Ukraine. The establishment of joint ventures by GM, Ford, Stellantis with Korean battery companies is an indication of their desire to receive a long-term, stable supply of batteries.

The automotive industry in any country is the pillar of its manufacturing industry, and as the world moves toward EVs in the future, how to make and supply batteries and procure materials will become extremely critical issues.

Japan is trailing China and South Korea in terms of volume, and it will be difficult to recover from this. It appears to be betting on all solid-state batteries and fuel cells. Given China’s enormous domestic demand, the volume for its own EVs alone will be substantial. The Korean battery industry will play a growing role in meeting demand in Europe and North America, the so-called liberal camp. PSR

Akihiro Komuro is Research Analyst, Far East and Southeast Asia, for Power Systems Research