SUMMARY: Considering sales across all power ranges, gen-set sales were off to a slower start in Q1 2017, down 5.5% compared to Q4 2016 levels. This decrease follows Q4 2016 where overall dealer reported sales were flat relative to Q3 2016 levels.

Anchoring the first quarter sales decrease were gaseous fueled gen-sets <300 kW reporting quarterly declines of at least 10% while gaseous gen-sets >300 kW decreased 3%. First quarter results for diesel were more stable with quarterly increases ranging from 3% to 5% in all power ranges >50 kW and diesel gen-sets <50 kW reporting a sales decrease from 3% to 4%.

On a Year-on-Year basis, unit sales for Q1 2017 were up 2.7% when compared to sales levels in Q1 2016.

Gen-Set dealers and distributors reported inventory levels in Q1 2017 were up 4.3% from Q4 2016 levels. Considering Year-on-Year changes, inventory levels at the end of Q1 2017 were 9.1% higher than the end of Q1 2016.

Although the start to 2017 was slow, dealers and distributors are optimistic, citing overall quarter-to-quarter sales growth in Q2 2017 ranging from 5% to 15%. Expectations for Q2 2017 were highest for gaseous fueled gen-sets in the <100 kW ranges with expected sales growth of 10% to 15% over Q1 2017 levels. Above 100 kW dealers expect sales of gaseous fueled units to increase 5% to 8%. Lower growth rates were anticipated during Q2 2017 for diesel fueled gen-sets with quarterly sales level increases ranging from 6% to 8%.

METHODOLOGY: Since 1998, Power Systems Research (PSR) has been continuously maintaining its PowerTrackerTM series of syndicated surveys, conducting 1,400 interviews each quarter among three key respondent groups in North America: gen-set dealers and distributors, businesses and households.

We conduct 200 interviews each quarter among dealers and distributors; the focus of this survey is on recent sales and market observations for the current quarter as well as expectations for the coming quarter.

Our Business Consumer survey consists of 900 interviews per quarter among a wide cross section of businesses to gather their input concerning ownership, usage trends and motivating factors for purchase, including any concerns about the reliability and availability of electric power.

Finally, our Household Consumer survey consists of 300 interviews per quarter to learn more about gen-set ownership trends among households and monitor the likelihood of a gen-set purchase.

Our latest results from the PowerTrackerTM dealer and distributor survey showed that overall sales of gen-sets during the first quarter of 2017 were down 5.5% relative to the fourth quarter of 2016.

Gaseous fueled gen-sets in power ranges <300 kW were down 10% while gaseous gen-sets >300 kW decreased 3%. The first quarter results for diesel were more stable with quarterly increases ranging from 3% to 5% in all power ranges >50 kW and diesel gen-sets <50 kW reporting a sales decrease of 3% to 4%. This follows Q4 2016 where overall dealer reported sales were flat relative to Q3 2016 levels.

On a Year-on-Year basis, unit sales for Q1 2017 were up 2.7% when compared to sales levels in Q1 2016.

Gen-Set dealers and distributors reported inventory levels in Q1 2017 were up 4.3% from Q4 2016 levels. Considering Year-on-Year changes, inventory levels at the end of Q1 2017 were 9.1% higher than the end of Q1 2016.

Dealer/Distributor Outlook for Second Quarter 2017

When asked about the short-term outlook, PowerTrackerTM dealer and distributor respondents were quite optimistic about a second quarter rebound with quarterly sales growth ranging from 5% to 15% depending on the fuel type and power range. Sales expectations for Q2 2017 were highest for gaseous fueled gen-sets in the <100 kW ranges with expected growth of 10% to 15% over Q1 2017 levels. Above 100 kW dealers expect sales of gaseous fueled units to increase 5% to 8%. Lower growth rates were anticipated during Q2 2017 for diesel fueled gen-sets with quarterly sales level increases ranging from 6-8%.

When asked, “Why do you expect sales to change in the upcoming quarter?” comments from dealers focused on the following market observations:

- Increased quote activity: Dealers noted that while the first quarter can generally be a slower time of the year, the second quarter normally means increased activity as the construction season picks up. Increased demand is also expected from residential consumers for portable gen-sets used in camping and other outdoor activities.

- Volatile summer weather: Summer storms and potential for outages due to downed trees and storm effects can boost sales.

When asked, “What changes have you recently noticed among particular customer groups or product categories within your market?” there were several comments that emerged as common themes:

- Increased competition and lower prices: There are more competitors on the market whether producing gen-sets or selling a private label brand. As a result price is normally the driving factor especially in the lower kW ranges.

- More competition from internet sales and big box stores

- Opportunity for gen-sets in a growing solar market: Some dealers indicated that while sales of solar power installations are increasing in popularity, this is driving some engine powered gen-set sales to provide back-up power to the solar systems.

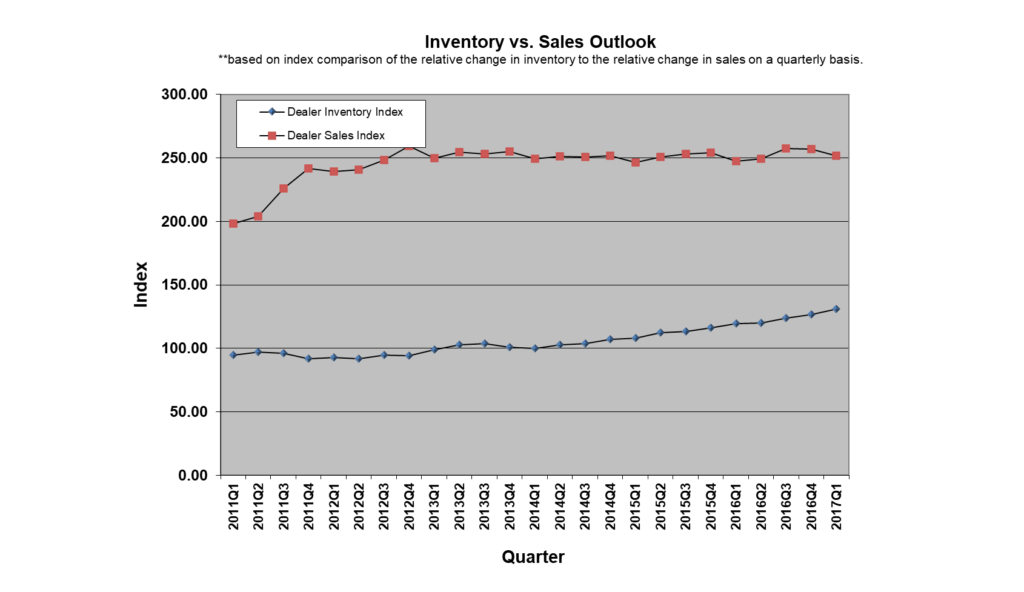

Even while sales levels year-to-year are fairly stable when considering in the context since 2011, inventory levels have been slowly rising since early 2014. Dealers have yet to start pulling back on inventory buildup; a continued sign that confidence exists in the near-term market prospects. PSR

Joe Zirnhelt is President and CEO at Power Systems Research (PSR), a market research and consulting company headquartered in St. Paul, MN.