SUMMARY: Our PowerTrackerTM dealer and distributor survey of 200 respondents reported that overall gen-set sales declined in Q1 2021 down 7.4% from Q4 2020 levels. This decrease follows three consecutive quarters in 2020 where dealers reported overall sales increases of 4.5% in Q2 2020 followed by 11.9% in Q3 2020 and 6.3% in Q4 2020.

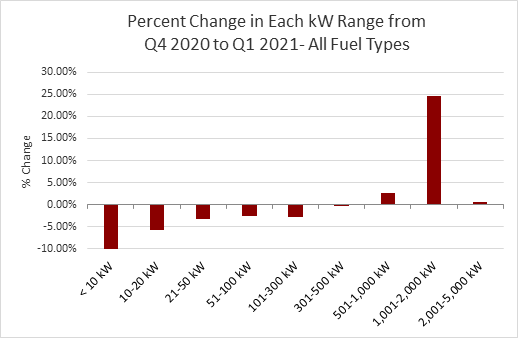

Although sales were down 7.4% in the first quarter, the results were unique in that there was a different story depending on the fuel and power range being considered.

The data comes from the proprietary PowerTrackerTM series of syndicated surveys conducted each quarter by Power Systems Research. A total of 300 interviews are completed each quarter with gen-set dealers and distributors and businesses across North America.

Within gaseous fueled gen-set ranges, the <10 kW range had a first quarter decrease of 9.6% while the 10-20 kW range experienced a decrease of 3.6%. Rounding out the <50 kW power range the 21-50 kW range for gaseous fuels was level with Q4 2020 levels. Keeping in mind that the 10-20 kW range and 21-50 kW ranges had experienced quarterly growth of greater than 10% in each Q3 2020 and Q4 2020 the slightly negative and flat growth in Q1 2021 still represents a strong sales level. Other power ranges within gaseous fueled gen-sets from 50-500 kW experienced quarterly increases ranging from 1.9% to 2.6% in contrast to Q4 2020 where quarterly sales were down 3% on average. Finally, the 501-1000 kW range experienced 9.6% growth in Q1 2021 – rebounding from two consecutive quarters of flat to slightly negative growth.

Sales of diesel fueled gen-sets improved slightly from the sharp declines of Q4 2020 but were still in negative growth territory for Q1 2021. Quarterly change across diesel <300 kW ranged from -4% to -9% while the 300-1000 kW range was flat. Finally, in the upper power ranges things were more positive with 1000-2000 kW reporting a 33% quarterly increase after four quarters of negative to slightly positive growth. The highest reported range of 2001-5000 kW reported an 8.3% increase after a similar scenario as the 1000-2000 kW range consisting of four previous quarters of negative to slightly positive growth.

Looking by application, portables were down 11% from Q4 2020 levels reflecting a shortage and backlog of available units in the smaller gasoline units. Base Load was up 6.5% from Q4 2021 levels which aligns with the quarterly increases observed in the gaseous (i.e. natural gas) type of gen- sets >500 kW.

In Q1 2021, dealers reported overall that inventories declined by 16.7% from Q4 2020 levels. The large quarterly decline in inventories for Q1 2021 follows a Q4 2020 where inventories fell 19.1%. As demand remains at high levels (despite the negative Q1 2021 sales growth) for residential standby units an overwhelming number of dealers reported they cannot maintain supply to meet customer demands. Year-on-Year, inventories are down 39% in Q1 2021 which reflects the inability dealers are facing to replenish inventory during this time of high demand and longer lead times. This is from a Year-on-Year change of -26% in Q3 2020 representing a total 12.9% shift in one quarter when considering Year-on-Year inventory levels in Q1 2021 relative to Q4 2020. Again, this seems to be due to dealers not being able to replenish needed inventories and not the case that dealers are hesitant towards placing orders for new inventory.

METHODOLOGY: Since 1998, Power Systems Research (PSR) has been continuously maintaining its PowerTrackerTM series of syndicated surveys, conducting at least 300 interviews each quarter among two key respondent groups in North America: gen-set dealers and distributors, and business consumers.

We conduct 200 interviews each quarter among dealers and distributors; the focus of this survey is on recent sales and market observations for the current quarter as well as expectations for the coming quarter.

Our Business Consumer survey consists of 100 interviews per quarter among a wide cross section of businesses to gather their input concerning ownership, usage trends and motivating factors for purchase, including any concerns about the reliability and availability of electric power.

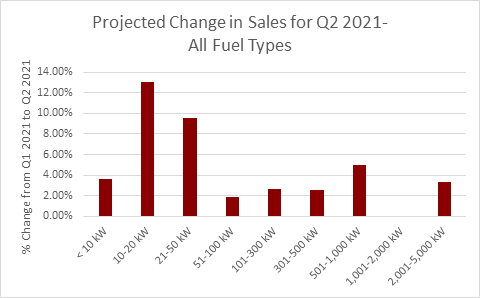

Dealer/Distributor Outlook for Q2 2021

Expectations of quarter-to-quarter sales growth for Q2 2021 varied depending on the power range and fuel type. Sales for diesel fueled sets are expected to continue to improve in Q2 2021 with growth between 2-6% for power ranges above 20 kW. Diesel fueled units less than 20 kW will see greater increases with 23% for the <10 kW units and 15.5% for 10-20 kW range. This continues our belief from last quarter that dealers seem to feel that the declines in diesel may have bottomed out and we will start to see some growth coming out of COVID and now into the peak of construction season.

Sales expectations for gaseous fueled gen-sets are expected to see a quarterly increase of 9% in the power ranges <50 kW. We see this as a positive sign that dealers believe lead times will improve and product will become more readily available. The outlook for gaseous fueled units above 50 kW is positive – ranging from 2% to 6% for Q2 2021.

When asked, “Why do you expect sales to change in the upcoming quarter?” comments from dealers focused on these market observations:

- Longer lead times for gen-set delivery to dealers: Similar to Q4 2020 over 30% of dealers interviewed during Q1 2020 cited long lead times and lack of inventory as a reason that their sales would be affected in the upcoming quarter. The lack of available product is delaying their sales pipeline. This was most specifically targeted with the smaller end of the range for residential and some small commercial standby sets (<50 kW).

- Product is starting to become available: In contrast to the first point concerning long lead times and lack of product availability, there were a small (minority) number of dealers that expressed some optimism surrounding the fact that they did see some relief in sight for the short supply of smaller rated portables and residential standby. Again, this was a smaller number of dealers overall but last quarter, for example, there were no mentions about light at the end of the tunnel in terms of seeing their backlog improve.

- Demand and activity levels: A growing number of dealers that commented on either demand or activity levels indicated a relatively strong market for gen-sets in their local area. Overall, the general sentiment reflected a total market that has some positive momentum at the current time. The economy in general is improving and a stronger business outlook will support continued sales.

When asked, “What changes have you recently noticed among particular customer groups or product categories within your market?” there were several comments that emerged as common themes. Many of these are comments that have carried from quarter to quarter, but this is a sample of some key observations:

- Significant increase in demand from residential for standby generators due to COVID-19 and general security of energy supply concerns.

- Potential customers are doing their homework before contacting the gen-set dealers. Customers quite often have a pretty good understanding of many of the considerations that need to be evaluated during the purchase process. There is still some education involved between the dealer and the customer, but the base knowledge level of the customer is noticeably improving. PSR

Joe Zirnhelt is President and CEO of Power Systems Research