INDIA REPORT

The commercial industry will grow with trucks and buses expected to do well. Truck sales will improve as many industries require more units as they are running at full capacity

The Indian economy managed to revive itself during the first and second COVID waves and quickly achieved a V-shaped recovery.

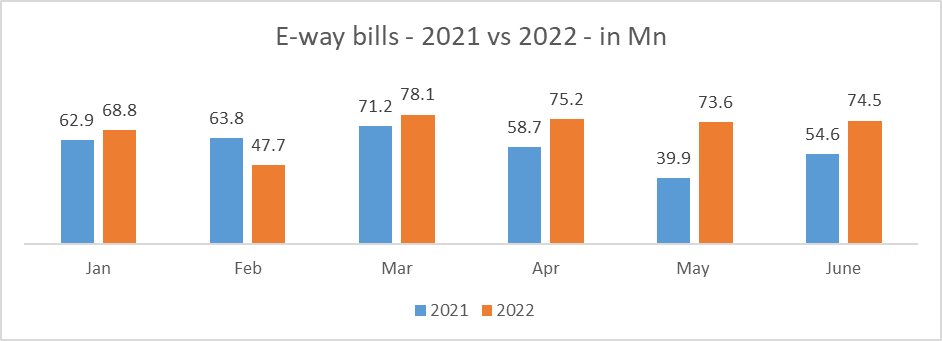

This year, GST is reaching high levels. GST collection has witnessed a growth of 26% YoY – YTD CY22. Furthermore, the generation of e-way bills is increasing rapidly. The generation of e-way bills is directly proportional to truck utilization and drives vehicle demand.

The goods carrier segment performance is closely aligned with the country’s GDP – which can be tracked from GST collections, and the way in which the macro-economic situation is improving, the industry sentiments seem to be very positive. This will be reflected in the overall CV production in the months and quarters ahead.

All the sectors of the economy are seeing momentum, and truck utilization levels are breaking records. Truck utilization has continuously remained above the last year’s levels. Improving demand from the core sectors like infrastructure, mining, steel, and cement is anticipated to provide the much needed thrust for the CV industry.

In the past few months, fuel prices have remained stable, while freight rates improved significantly. As a result, operators are seeing an increase in profitability. These positive sentiments will drive the new purchases.

Source: DT Next Read The Article

PSR Analysis: We expect a favorable business environment in the current year despite ongoing semiconductor shortages, which is the biggest hurdle in meeting increased demand.

Since 2020, the CV industry has lost volumes because of pandemic-related disruptions and delayed replacement demand.

The CV industry’s channel inventory is stressed due to the mismatch in supply and demand. The channel inventory has been low, at about 10 days against an average of 4-5 weeks. We hope that this year the supply chain situation will continue to improve without disruptions. Also, the semiconductor shortage situation might start easing out.

Hence, we believe the CV industry will continue its growth until the general election that is scheduled in 2024. We might see a post-election dip in 2024, but the industry is not expected to face severe headwinds and will equal 2018 volumes in 2027. PSR

Aditya Kondejkar is Research Analyst – South Asia Operations for Power Systems Research