This forecast appeared in the September 2019 issue of Diesel Progress magazine.

SUMMARY. The underlying weak conditions in the global economic picture could put pressure on the North American power generation industry for the remainder of 2019 and through most of 2020. We forecast little or no growth for the industry through 2020.

Even though the power generation production market was up slightly (0.9% in 2018-2019), we see it declining about 1% over the next year.

For those of you a few years removed from your high school U.S. History courses, the original Gilded Age was a period covering the 1870s-1890s that was marked by astonishing economic growth. Driven by the expansion of industrialization in the North and West, facilitated by growing railroad networks, real wages grew an enviable 60%.

But Mark Twain dubbed this period the “Gilded Age” rather than the “Golden Age,” because it was also marked by extreme poverty, and he represented it with gilded, decaying apple. The shiny outward appearance of growth was masking a rotten core of massive inequality.

Our Gilded Age today is marked by a glowing exterior of strong economic indicators which mask much less healthy fundamentals. The last Gilded Age ended when the Progressive Era worked to lift the bottom up, while ours seems poised to have the bottom fall out from under it.

All that Glitters…

The economy looks great on the surface.

The current expansion has lasted 10 years, the longest in U.S. history, and its most recent markers were a very strong 3.1% GDP growth in Q1 2019 and a still strong 2.1% in Q2 2019. Unemployment is at a 50-year low of 3.6%. Housing starts are slightly down from a few months ago but have expanded 6.2% YoY. Consumer spending was slow in Q1 2019 but accelerated to 0.4% growth in May and June. The economy looks healthy, demand seems like it should be strong, and it follows that the power generation segment should also grow.

…Is Sometimes Just Fool’s Gold.

And yet, something is clearly out of whack with the economy. The Fed just cut interest rates, something it typically does to counteract an economic downturn after the fact. Our partners at IHS Markit are projecting that U.S. growth declines to 1.7% average growth for the next few years.

The Fed’s recession probability index has hit 32%, the highest since 2009 (30% is typically used as a barometer for when we are at serious risk for a recession). The Purchasing Manager’s Index has been contracting, indicating that manufacturers expect a significant slowdown in activity.

Perhaps most tellingly, the Treasury bond yield curve inverted in March, meaning that investors are so worried about an economic downturn, they are willing to lock in low return rates now to avoid rates falling even lower later. Since this yield curve change often precedes a recession, we should not be surprised if we see recession type conditions early in 2020.

So why does it feel like the world is on the edge? Why are some people treating this golden apple like it’s full of rot? It comes down to three factors.

1. Tariffs. Tariffs are the cause for much concern in the American economy. Tariffs have reshuffled supply chains to higher-cost countries, cut off export markets, and cast uncertainty over investments. With the President announcing in August a further $300 billion tariff on Chinese imports, it’s safe to say the pivotal tariff factor isn’t going away anytime soon.

2. Global Slowdown. As the U.S. looks at a possible recession, no other region of the world is growing quickly enough to buoy the global economy. One example: China’s economic growth is slowing; it dropped to 6.2% (a 27-year low) in Q2 2019.

3. Presidential Election Season is Right Around the Corner. Businesses typically hesitate to invest during a Presidential election year, opting to take a “wait and see” approach on spending for growth initiatives. Adding trade uncertainty and a global slowdown at the same time makes a good recipe for at least a downturn, if not an outright recession.

What Does This Have to Do with Power Generation?

Demand for power generation is a decent bellwether for the economy. Housing starts are important because more housing construction means a greater immediate demand for temporary power on construction sites and a greater proximal demand for both temporary power on the site of expanding infrastructure construction (roads to new houses) and standby power at those new houses.

When businesses are expanding, they are more likely to invest in emergency backup power.

When real wages are growing, consumers (especially those in the paths of ice storms, hurricanes, and wildfires) may feel like they can spend a little extra to get a standby generator for their home. In fact, PowerTrackerTM, our quarterly survey of 200 North American dealers (https://www.powersys.com/products-services/syndicated-surveys/powertracker-north-america), repeatedly tells us that when the economy turns sour, generator sales are one of the first items to dry up.

We can see this concern reflected in the power generation market, which appears to be at a turning point. Overall, the power generation production market was up 0.9% in 2018-2019, but considering all fuel types and power ranges, we are projecting it down about 1% over the next year.

Traditional fuel types are going to bear the brunt of the downturn. Diesel was about flat over the last year but is projected down 1.8% over the next year. The largest changes will come in the 10-20kW and 21-50kW ranges, with 10-20kW falling almost 2.8% and 21-50kW dipping about 2.1%. Gasoline gen-set production was also about flat last year and is expected to decline 1.7% over the next year. All gasoline power ranges are expected to decline about 1.5%-1.75%.

| Production of Generator Sets by North American OEMs | ||||||

| Diesel | Gasoline | LPG & Natural Gas | ||||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | |

| <10kW | 27,065 | 26,602 | 519,581 | 510,824 | 37,596 | 37,909 |

| 10-20kW | 17,885 | 17,374 | 108,806 | 107,106 | 61,224 | 62,192 |

| 21-50kW | 24,446 | 23,924 | 3,765 | 3,699 | 43,205 | 43,860 |

| 51-100kW | 19,859 | 19,558 | 45 | 44 | 38,608 | 39,188 |

| 101-300kW | 26,189 | 25,759 | 19,508 | 19,803 | ||

| 300-500kW | 7,237 | 7,138 | 931 | 950 | ||

| 501-1000kW | 7,094 | 7,027 | 2,052 | 2,091 | ||

| 1001-2000kW | 3,294 | 3,273 | 953 | 970 | ||

| 2001-5000kW | 1,995 | 1,980 | 63 | 63 | ||

| >5000kW | 11 | 11 | ||||

| Grand Total | 135,064 | 132,635 | 632,197 | 621,673 | 204,151 | 207,037 |

LPG & Natural Gas are not going to be immune to the effects of the slowdown either. These fuel types won’t decline, but they will certainly slow. Production of these gen-sets was up about 3.3% in the 2018-2019 period and is expected to be up only about 1.4% in the 2019-2020 period.

We are forecasting the strongest growth in the 301-500kW and 501-1000kW ranges for LPG & Natural Gas at about 2%. The weakest growth will be in the very largest power ranges which will be about flat, with all other power ranges growing between 1-2%.

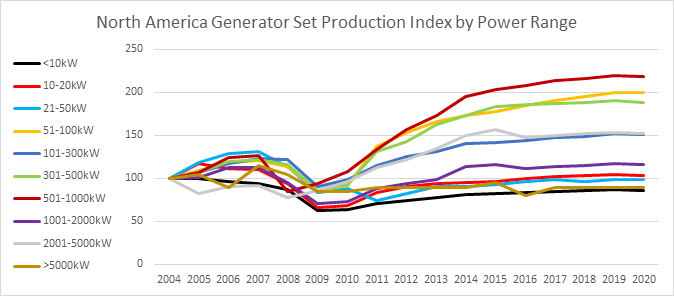

In addition to gloomy macroeconomic signals like the yield curve inversion and a lackluster projection for next year, PSR has historical data prior to the previous recession, and we see some worrying similarities. Only twice in the last 15 years have all power ranges experienced nearly flat growth: shortly before the dramatic collapse in 2008-2009, and in our forecast for 2019-2020.

The reality is this: growth has been slowing for the last five years. While GDP had been accelerating up to Q2 2019, the brunt of the recovery for the power generation segment took place prior to 2014.

No power range has grown more than 501-1000kW segment. In the five years after the 2008-2009 collapse, production doubled in this power range. In the five years after that, from 2014-2019, production volume grew only about 10%. The drop off began earlier for the 21-300kW ranges and 2-5MW range.

Hope for a positive turn is clouded by the mismatch between macroeconomic indicators and historical growth in each power range. The ranges that have seen expansion over the last 10 years are expected to see their demand drivers dwindle, and the ranges that should have great potential for growth after a lackluster post-2008 recovery are not responding to positive economic indicators.

Using 2004 as a pre-recession base year, it is the commercial power ranges, used in construction and business standby, that have been growing and more recently slowing. The post-2008 recovery of the segment has been built on these middle power ranges.

But business consumers are the ones now showing signs of curtailing investments in the face of trade uncertainty. The strongest power ranges are not expected to continue pulling the segment along.

We might expect the weakest-performing power ranges, <10kW, 10-20kW, and even 21-50kW to benefit from seemingly strong housing starts and strong consumer spending, but these ranges are projected to turn down again after hovering at or below 2004 production levels. The only one of these three power ranges to have returned to pre-recession levels is the 10-20kW range. Production in this range surpassed 2004 levels in 2017, driven by an exceptional hurricane and wildfire season which highlighted the need for home standby generators. But even with strong consumer spending and high salience, this power range is projected to decline next year.

Although the recovery in the power generation segment has been strong over the last 10 years, it has been uneven. LPG & Natural gas gen-set production is projected to continue expanding, but not enough to offset projected losses in gasoline and diesel.

The middle-tier power ranges that have been driving the recovery of the segment since 2009-2010 are facing a business community that has signaled a desire to hold off on further investment until trade tensions have been resolved, which the President has now stated will likely be after the next election in 2020.

Production of smaller gen-sets has never really recovered from the last recession, despite a decade of economic growth and improving consumer spending, and it does not seem likely that they would pick up now when talk of recession is in the air. If past is prologue, a simultaneous flattening of all these growth curves portends a greater decline.

Does this Decaying Apple have Good Seeds?

A top concern cited by 69% of the 14,000 member companies of the National Association of Manufacturers (NAM) is the rising skills gap, making it a greater worry than tariffs or rising materials costs. Although organizations like the NAM, for the manufacturing sector, and the Electrical Generating Systems Association (EGSA), for the power generation segment, are working to attract more people to manufacturing and technical positions, the skills gap remains a long-term threat to growth and competitiveness.

For the immediate future, the concern of the power generation segment is whether consumers will overcome their uncertainty over trade wars, global slowdown, and impending elections and how this activity might impact the overall demand for power generation products.

The longer-term question centers around workforce and talent pool questions. As long as these challenges surrounding talent acquisition are embraced and kept in focus, North American OEMs come through recessionary times with good seeds in the process. PSR

Tyler Wiegert is a Project Manager at Power Systems Research (PSR), a market research and consulting company headquartered in St. Paul, MN.