MOSCOW—(TASS) Sales of heavy trucks in Russia in 2025 may decline by 23% year-on-year to 85,000 units, Mikhail Matasov, Deputy General Director of the Russian truck producer Kamaz, told reporters. “The market will be poor in 2025. We currently estimate it at 85,000 units against 110,000 this year. We think that 85,000 is even optimistic,” he said.

Matasov noted that the decline in sales can be attributed to a decrease in demand for cargo transportation.

“If there is no construction, then there will be fewer dump trucks (needed). We also provide trucks for cargo transportation industry – if there are fewer of them, then there will be fewer haulage trucks,” he explained.

“The plan for 2025 is, in my opinion, 10,000 units. But we don’t know if there will be that many, because Chinese brands have large warehouse stocks,” Matasov added.

Earlier, the National Agency for Direct Investments (NAPI) presented a forecast according to which sales of new trucks in 2025 may decrease by 13.5% year-on-year to 110,400.

Under the baseline sales scenario for 2024, sales of trucks will total 127,800 units. Under a positive scenario, the volume of sales of new trucks in 2025 will be 120,600, under a pessimistic scenario it will be 100,300 units.

PSR Analysis. While demand for medium and heavy commercial trucks declined in 2024 primarily due to high financing rates, production of military cargo trucks appears to have increased significantly last year as the military had higher demand for replacement vehicles from URAL and KAMAZ. This year, demand is expected to be significantly lower.

As the article points out, lower cargo demand and a generally slower economy will result in lower vehicle sales. MHCV production in 2025 is expected to decline sharply from 2024 as a result of a decline in cargo truck demand and high warehouse stocks of imported Chinese trucks.

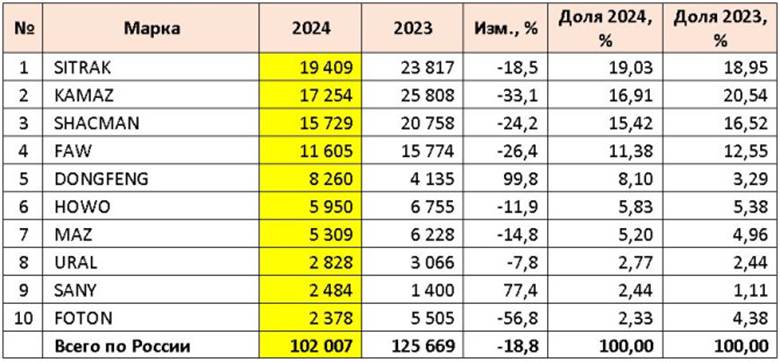

What is interesting is the increased imports from Chinese truck OEMs and how that has somewhat reshaped the Russian commercial vehicle landscape. The Chinese OEMs more than replaced the Western European OEMs in Russia during the past few years. In terms of unit sales for heavy trucks, seven of the top 10 OEMs were Chinese. See the sales chart from Avtostat. PSR

Source: Avtostat

Chris Fisher is Senior Commercial Vehicle Analyst at Power Systems Research